Answered step by step

Verified Expert Solution

Question

1 Approved Answer

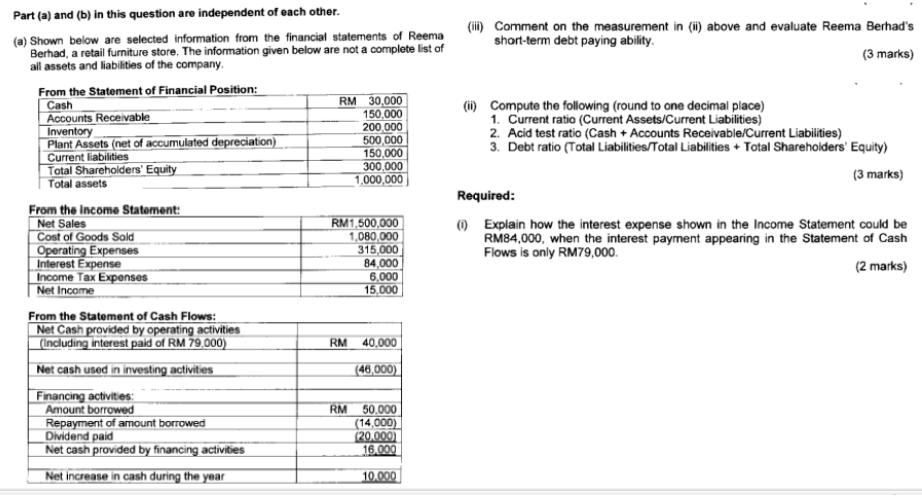

Part (a) and (b) in this question are independent of each other. (a) Shown below are selected information from the financial statements of Reema

Part (a) and (b) in this question are independent of each other. (a) Shown below are selected information from the financial statements of Reema Berhad, a retail furniture store. The information given below are not a complete list of all assets and liabilities of the company. From the Statement of Financial Position: Cash Accounts Receivable Inventory Plant Assets (net of accumulated depreciation) Current liabilities Total Shareholders' Equity Total assets From the income Statement: Net Sales Cost of Goods Sold Operating Expenses Interest Expense Income Tax Expenses Net Income From the Statement of Cash Flows: Net Cash provided by operating activities (including interest paid of RM 79,000) Net cash used in investing activities Financing activities: Amount borrowed Repayment of amount borrowed Dividend paid Net cash provided by financing activities Net increase in cash during the year RM 30,000 150,000 200,000 500,000 150,000 300,000 1,000,000 RM1,500,000 1,080,000 315,000 84,000 6,000 15,000 RM 40,000 (46,000) RM 50.000 (14,000) (20,000) 16.000 10.000 (iii) Comment on the measurement in (ii) above and evaluate Reema Berhad's short-term debt paying ability. (3 marks) (ii) Compute the following (round to one decimal place) 1. Current ratio (Current Assets/Current Liabilities) 2. Acid test ratio (Cash + Accounts Receivable/Current Liabilities) 3. Debt ratio (Total Liabilities/Total Liabilities + Total Shareholders' Equity) (3 marks) Required: (1) Explain how the interest expense shown in the Income Statement could be RM84,000, when the interest payment appearing in the Statement of Cash Flows is only RM79,000. (2 marks)

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

STEP 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started