After deducting capital allowances for the year to 31 December 2019, the tax written down values of

Question:

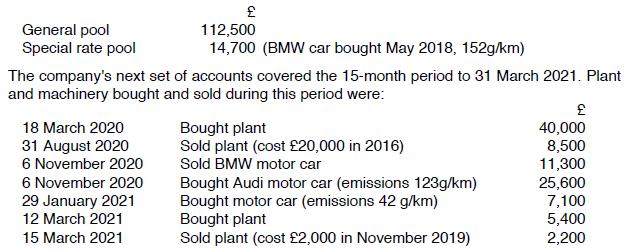

After deducting capital allowances for the year to 31 December 2019, the tax written down values of a company's plant and machinery were as follows:

Calculate the capital allowances available for the 15 months to 31 March 2021, assuming 20% private use of the BMW and Audi motor cars by a director of the company.

Transcribed Image Text:

General pool Special rate pool 112,500 14,700 (BMW car bought May 2018, 152g/km) The company's next set of accounts covered the 15-month period to 31 March 2021. Plant and machinery bought and sold during this period were: 18 March 2020 31 August 2020 6 November 2020 6 November 2020 29 January 2021 12 March 2021 15 March 2021 Bought plant Sold plant (cost 20,000 in 2016) Sold BMW motor car Bought Audi motor car (emissions 123g/km) Bought motor car (emissions 42 g/km) Bought plant Sold plant (cost 2,000 in November 2019) 40,000 8,500 11,300 25,600 7,100 5,400 2,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

The 15month period of account must be broken down into two acco...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

After deducting capital allowances for the year to 31 December 2016, the tax written down values of a company's plant and machinery were as follows: General pool Special rate pool 112,500 14,700 (BMW...

-

Talat owns a large retail business and prepares accounts to 31 December each year. The written down value of his plant and machinery after deducting capital allowances for the year to 31 December...

-

Talat owns a large retail business and prepares accounts to 31 December each year. The written down value of his plant and machinery after deducting capital allowances for the year to 31 December...

-

(a) A proton is moving at a speed much slower than the speed of light. It has kinetic energy K1 and momentum P1. If the momentum of the proton is doubled, so P2 = 2p1 how is its new kinetic energy K2...

-

Find someone who needs computer support and solve their problem. Identify someone who is having a problem with technology. The problem should not be simple or simplistic in nature. The person you...

-

For the same inputs as problem 2, determine the replicating portfolio and the price of the call and put using an eight-period, replicating portfolio model.

-

E8.9. Calculating Comprehensive Income to Shareholders: Intel Corporation (Medium) The following is adapted from the statement of shareholders' equity for IntelCorporation for2000(in millions of...

-

Selected transactions on the books of Pfaff Corporation follow: May 1, 2014 Bonds payable with a par value of $700,000, which are dated January 1, 2014, are sold at 105 plus accrued interest. They...

-

Company Z does not anticipate increasing dividends for the foreseeable future. If the company's most recent dividend payment was $3.25 a share and the most recent stock price was $40 a share, what is...

-

A company prepares accounts to 31 December each year and lets two properties to tenants. The following information relates to the year to 31 December 2020: (a) Property A is owned by the company. The...

-

A company's income statement for the year to 31 December 2020 is as follows: Compute the company's trading income (before deduction of capital allowances) for the year to 31 December 2020. Turnover...

-

In Example 4.4, a two-tank system is presented. Using state-space notation, determine the matrices A, B, C, and E, assuming the level deviations h1 and h2 are the state variables, the input variable...

-

James A. and Ella R. Polk, ages 70 and 65, respectively, are retired physicians who live at 3319 Taylorcrest Street, Houston, Texas 77079. Their three adult children (Benjamin Polk, Michael Polk, and...

-

I need help solving the following question: - Thank you in advance. On January 1, Year 6, HD Lid., a building supply company, JC Lid., a construction company, and Mr. Saeid, a private investor,...

-

Let X 1 , , X n X 1 , , X n be a random sample from a normal distribution with mean and variance 1. Find the uniformly minimum variance unbiased estimator of 2 2 .2 answers

-

The ledger of Duggan Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. Debit Credit Prepaid Insurance $3,600 Supplies...

-

1.Using the Excel file Sales transaction find the following15 Marks a.Identify the levels of measurement for each variables b.Construct a cross tabulation to find the number of transactions by...

-

What is real-time BI, and why is this technology valuable to an organization's managers and executives?

-

The graph of the sequence whose general term is an = n - 1 is which of the following? [8.1] A. B. TITTT 3-2-1 23.45 2.3.4

-

On 31 March 2011, Martha gave 500,000 to her daughter as a wedding present. On 1 April 2012 she gave 497,000 to a relevant property trust. Martha died on 1 January 2018, having made only these two...

-

Wilson dies on 20 December 2017 , having made only the following transfers during his lifetime: 6 June 2007 4 March 2011 11 January 2012 Gift to daughter Gift to relevant property trust Gift to son...

-

On 1 July 2017 , Violet makes a chargeable lifetime transfer (after deduction of relevant exemptions) of 48,000. Her only previous chargeable lifetime transfer was made in 2013 and had a gross value...

-

Minden Company introduced a new product last year for which it is trying to find an optimal selling price. Marketing studies suggest that the company can increase sales by 5,000 units for each $2...

-

Prepare the adjusting journal entries and Post the adjusting journal entries to the T-accounts and adjust the trial balance. Dresser paid the interest due on the Bonds Payable on January 1. Dresser...

-

Venneman Company produces a product that requires 7 standard pounds per unit. The standard price is $11.50 per pound. If 3,900 units required 28,400 pounds, which were purchased at $10.92 per pound,...

Study smarter with the SolutionInn App