A company prepares accounts to 31 December each year and lets two properties to tenants. The following

Question:

A company prepares accounts to 31 December each year and lets two properties to tenants.

The following information relates to the year to 31 December 2020:

(a) Property A is owned by the company. The property was let from 1 January 2020 to 30 June 2020 at an annual rent of £9,600, payable monthly in advance. However, the rent due on 1 May and 1 June 2020 was not paid and the tenant then absconded. The company has now written off this rent as a bad debt.

Having advertised for a new tenant (cost £200), the company re-let the property from 1 September 2020 at an annual rent of £10,200, payable monthly in advance. The rent due on 1 December 2020 was not received until 3 January 2021.

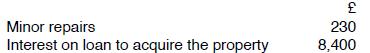

Apart from advertising, the only other expenses incurred by the company in relation to Property A during the year to 31 December 2020 were:

(b) Property B is a leasehold property which was acquired by the company on 1 October 2020. The company paid a premium of £120,000 for the grant of a 25-year lease but is not required to pay rent. As from 1 October 2020, this property was let to a tenant at an annual rent of £12,000. The first year's rent was paid in advance. The tenant also paid a premium of £40,000 for the grant of a 10-year lease.

No expenses were incurred in relation to this property during the year.

Calculate the company's property business profit for the year to 31 December 2020.

Step by Step Answer: