The adjusted trial balance of Gold Sign Company follows: Requirements 1. Assume Gold Sign Company has a

Question:

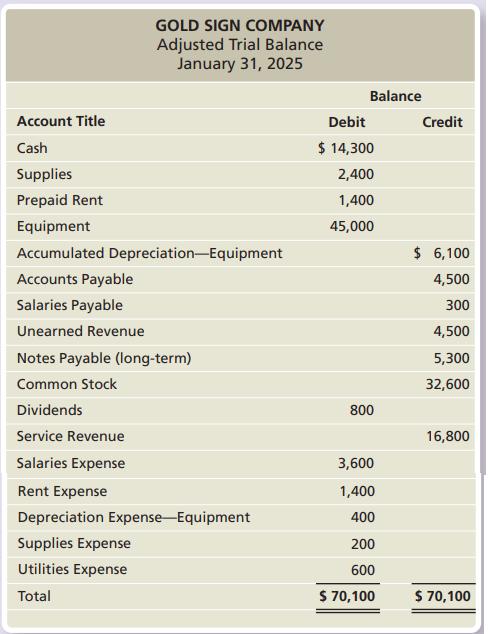

The adjusted trial balance of Gold Sign Company follows:

Requirements

1. Assume Gold Sign Company has a January 31 year-end. Journalize Gold Sign Company’s closing entries at January 31.

2. How much net income or net loss did Gold Sign Company earn for the year ended January 31? How can you tell?

GOLD SIGN COMPANY Adjusted Trial Balance January 31, 2025 Account Title Cash Supplies Prepaid Rent Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Common Stock Dividends Service Revenue Salaries Expense Rent Expense Depreciation Expense-Equipment Supplies Expense Utilities Expense Total Balance Debit $ 14,300 2,400 1,400 45,000 800 3,600 1,400 400 200 600 $ 70,100 Credit $ 6,100 4,500 300 4,500 5,300 32,600 16,800 $ 70,100

Step by Step Answer:

Account Title Debit Credit Closing Entries Service Revenue 16800 Salaries Expense 360...View the full answer

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9780137858651

8th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The adjusted trial balance of Smith Sign Company follows: Requirements 1. Assume Smith Sign Company has a January 31 year-end. Journalize Smiths closing entries at January 31. 2. How much net income...

-

The adjusted trial balance of Stone Sign Company follows: Requirements 1. Assume Stone Sign Company has a January 31 year-end. Journalize Stone's closing entries at January 31. 2. How much net income...

-

The adjusted trial balance from the January worksheet of Silver Sign Company follows: Requirements 1. Journalize Silvers closing entries at January 31. 2. How much net income or net loss did Silver...

-

A particle of mass m moves in a certain plane P due to a force F whose magnitude is constant and whose vector rotates in that plane with a constant angular velocity . Assuming the particle to be...

-

You have approached your local bank for a start-up loan commitment for $250,000 needed to open a computer repair store. You have requested that the term of the loan be one year. Your bank has offered...

-

On January 2, 2011, Phillips Company purchased 80% of Sanchez Company and 90% of Thomas Company for $225,000 and $168,000, respectively. Immediately before the acquisitions, the balance sheets of the...

-

What is the difference between primary and secondary markets? AppendixLO1

-

The Houston Corporation acquires machinery from the South Company in exchange for a $20,000 non-interest-bearing, five-year note on June 30, 2006. The note is due on June 30, 2011. The machinery has...

-

When the market rate of interest is greater than the contract rate of interest, the bonds should sell at a. a premium b. par value c. a discount d. face value

-

Using a table similar to that shown in Figure 3.6, calculate the product of the octal unsigned 6-bit integers 62 and 12 using the hardware described in Figure 3.3. You should show the contents of...

-

The unadjusted trial balance of Konnors Game Shop at December 31, 2025, and the data for the adjustments follow: Adjustment data: a. Unearned Revenue still unearned at December 31, $400. b. Prepaid...

-

Clean Pool Service had the following selected accounts and normal balances listed on its December 31 adjusted trial balance: Service Revenue Accounts Payable Salaries Expense Common Stock Utilities...

-

An airline elects to finance the purchase of some new airplanes using equipment trust certificates. Under the legal arrangement associated with such certificates. the airplanes are pledged as...

-

Write a java program that contain two overloaded methods that accepts two numbers or two characters representing a range example (11, 37) or (c, w) inputted by the user. The method generates a random...

-

Maggie could not conceive a child using natural means, so she sought out a woman who would donate an egg to be surgically implanted in Maggie. Which of the following items are deductible by Maggie in...

-

M corporation is subject to tax only in state b state b law provides for the use of federal taxable income before net operating loss and special deductions as the starting point for computing state...

-

Use Routh Criteria to determine the values of K needed for the system represented by the Characteristic Equation to be stable. (1 + K)s + (2K + 3)s + 2 3K = 0 Obtain the root locus plot for the...

-

Q7 a) Two forces equal to 2P and P act on a particle. If the first be doubled and second is increased by 12N, the direction of resultant remains unaltered. Find the value of P (5)

-

Big Bend Co. fixed budget for the year is shown below: Prepare a flexible budget for Big Bend Co. that shows a detailed budget for its actual sales volume of 42,000 units. Use the contribution margin...

-

Explain how the graph of each function can be obtained from the graph of y = 1/x or y = 1/x 2 . Then graph f and give the (a) Domain (b) Range. Determine the largest open intervals of the domain over...

-

Describe how each portion of a blended mortgage payment changes over the life of the mortgage.

-

T&T Marina needs to raise $2 million to expand. T&Ts president is considering two plans: Plan A: Issue $2,000,000 of 8 percent bonds payable to borrow the money Plan B: Issue 100,000 common shares...

-

Moe Jones Inc. issued $400,000 of 8 percent, 10-year bonds payable at a price of 114.88 on May 31, 2020. The market interest rate at the date of issuance was 6 percent, and the Moe Jones Inc. bonds...

-

An estimated 84 percent of enterprises now use cloud computing solutions involving multiple clouds, whereas less than 10 percent of large organizations employ just a single public cloud. Group of...

-

XYZ inc. was involved in a tax dispute with the national tax authority. The companys legal counsel estimates that there is a 75% likelihood that the company will lose the dispute and that the amount...

-

3 . Accounting.. How does depreciation impact financial statements, and what are the different methods of depreciation?

Study smarter with the SolutionInn App