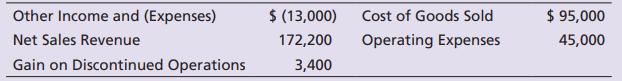

TLM Corporations accounting records include the following items, listed in no particular order, at December 31, 2025:

Question:

TLM Corporation’s accounting records include the following items, listed in no particular order, at December 31, 2025:

The income tax rate for TLM Corporation is 21%.

Prepare TLM Corporation’s income statement for the year ended December 31, 2025. Omit earnings per share. Use the multi-step format.

Transcribed Image Text:

Other Income and (Expenses) Net Sales Revenue Gain on Discontinued Operations $ (13,000) Cost of Goods Sold 172,200 Operating Expenses 3,400 $ 95,000 45,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (6 reviews)

TLM Corporation Income Statement For the Year Ended December 31 2025 Sales Revenue 150...View the full answer

Answered By

Joshua Marie Geuvara

I am an academic writer with over 5 years of experience. I write term papers, essays, dissertations, reports, and any other academic paper. My main objective is to produce a high-quality paper free from plagiarism and ensure a student scores an A+. Being a fluent English speaker, I have great communication skills that also enable me to produce excellent papers.

I am conversant with most academic referencing styles (APA, MLA, and Harvard).

You can trust me with your paper and expect nothing less than quality and excellent results. I look forward to meeting with you and, more importantly, developing something that will both make us happy and satisfied.

0.00

0 Reviews

10+ Question Solved

Related Book For

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9780137858651

8th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted:

Students also viewed these Business questions

-

RAR Corporations accounting records include the following items, listed in no particular order, at December 31, 2015: The income tax rate for RAR Corporation is 30%. Prepare RARs income statement for...

-

ABC Corporations accounting records include the following items, listed in no particular order, at December 31, 2024: The income tax rate for ABC Corporation is 21%. Prepare ABCs income statement for...

-

TST Corporations accounting records include the following items, listed in no particular order, at December 31, 2016: The income tax rate for TST Corporation is 50%. Prepare TSTs income statement for...

-

Explain the Mechanism & routes of administration of SEDDS (Self emulsifying drug delivery system).

-

Using the eight design descriptions, profile the MindWriter CompleteCare satisfaction study as described in this and preceding chapters.

-

Healthcheck Corp. manufactures an antacid product that passes through two departments. Data for June for the first department follow: The beginning work in process inventory was 80% complete with...

-

Natalie and Curtis have comparative balance sheets and income statements for Cookie & Coffee Creations Inc. They have been told that they can use these fi nancial statements to prepare horizontal and...

-

At a particular axial station, velocity and temperature profiles for laminar flow in a parallel plate channel have the form u(y) = 0.75[1 (y/y o ) 2 ] T(y) = 5.0 + 95.66(y/y o ) 2 47.83(y/yo) 4...

-

What is the percentage change in total revenues from 2018 to 2019? Round to the nearest one-tenth of 1% (i.e., 87.2). What is the percentage change in total expenses from 2018 to 2019? Round to the...

-

Telco Ltd. is a Danish telecom company that prepares consolidated financial statements in full compliance with IFRS 10. The company has expanded dramatically in Central Asia in recent years by...

-

The Grove, Inc. issued $300,000 of 11%, 10-year bonds payable on January 1, 2025. The market interest rate at the date of issuance was 10%, and the bonds pay interest semiannually. Requirements 1....

-

Turtle Co. had beginning retained earnings of $800,000 on January 1, 2025. During the year, Turtle Co. declared and paid $65,000 of cash dividends and earned $240,000 of net income. In addition,...

-

On December 1, 2013, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD). Collection of the receivable is due on February 1, 2014. Keenan...

-

An important first step of exploratory data analysis is always to visualize the data. Construct a scatterplot of each time series (i.e., two different plots). If you need pointers on how to make a...

-

Cleanie Wombat Cleanie Wombat is a small Australian company that makes cleaning products. The chemical formulas used for its products were developed through R&D conducted by the company's small R&D...

-

As a manager at Yummy Melts, Martin is responsible for the firm's Just Right brand of ice cream. He recently approved a proposal to test market new ice cream flavors. He is also considering the...

-

Cogenesis Corporation is replacing their current steam plant with a 6-megawatt cogeneration plant that will produce both steam and electric power for their operations. What is the impact of a 5% and...

-

Suppose ABC firm is considering an investment that would extend the life of one of its facilities for 5 years. The project would require upfront costs of $9.97M plus $28.94M investment in equipment....

-

In DNSSEC, what are the advantages of separating the functions of KSK and ZSK?

-

What key concerns must functional tactics address in marketing? Finance? POM? Personnel?

-

Theodore McMahon opened a law office on April 1, 2024. During the first month of operations, the business completed the following transactions: Requirements 1. Record each transaction in the journal,...

-

Beth Stewart started her practice as a design consultant on November 1, 2024. During the first month of operations, the business completed the following transactions: Requirements 1. Record each...

-

Beth Stewart started her practice as a design consultant on November 1, 2024. During the first month of operations, the business completed the following transactions: Requirements 1. Record each...

-

Just work out the assignment on your own sheet, you dont need the excel worksheet. Classic Coffee Company Best friends, Nathan and Cody, decided to start their own business which would bring great...

-

Financial information related to the proprietorship of Ebony Interiors for February and March 2019 is as follows: February 29, 2019 March 31, 2019 Accounts payable $310,000 $400,000 Accounts...

-

(b) The directors of Maureen Company are considering two mutually exclusive investment projects. Both projects concern the purchase of a new plant. The following data are available for each project...

Study smarter with the SolutionInn App