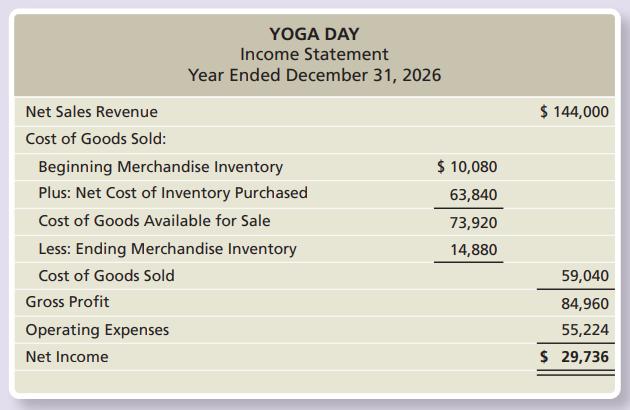

Yoga Day reported the following income statement for the year ended December 31, 2026: Requirements 1.

Question:

Yoga Day reported the following income statement for the year ended December 31, 2026:

Requirements

1. Compute Yoga Day’s inventory turnover rate for the year. (Round to two decimal places.)

2. Compute Yoga Day’s days’ sales in inventory for the year. (Round to two decimal places.)

Transcribed Image Text:

Net Sales Revenue Cost of Goods Sold: YOGA DAY Income Statement Year Ended December 31, 2026 Beginning Merchandise Inventory Plus: Net Cost of Inventory Purchased Cost of Goods Available for Sale Less: Ending Merchandise Inventory Cost of Goods Sold Gross Profit Operating Expenses Net Income $ 10,080 63,840 73,920 14,880 $ 144,000 59,040 84,960 55,224 $ 29,736

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 37% (8 reviews)

ANSWER To compute Yoga Days inventory turnover rate and days sales in inventory we need to use the i...View the full answer

Answered By

Surendar Kumaradevan

I have worked with both teachers and students to offer specialized help with everything from grammar and vocabulary to challenging problem-solving in a range of academic disciplines. For each student's specific needs, I can offer explanations, examples, and practice tasks that will help them better understand complex ideas and develop their skills.

I employ a range of techniques and resources in my engaged, interesting tutoring sessions to keep students motivated and on task. I have the tools necessary to offer students the support and direction they require in order to achieve, whether they need assistance with their homework, test preparation, or simply want to hone their skills in a particular subject area.

0.00

0 Reviews

10+ Question Solved

Related Book For

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9780137858651

8th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted:

Students also viewed these Business questions

-

Calm Day reported the following income statement for the year ended December 31, 2019: Requirements 1. Compute Calm Day's inventory turnover rate for the year. (Round to two decimal places.) 2....

-

Calm Day reported the following income statement for the year ended December 31, 2025: Requirements 1. Compute Calm Days inventory turnover rate for the year. 2. Compute Calm Days days sales in...

-

New Hope reported the following income statement for the year ended December 31, 2016: Requirements 1. Compute New Hopes inventory turnover rate for the year. (Round to two decimal places.) 2....

-

Consider a two-stage compression refrigeration system operating between the pressure limits of 0.8 and 0.14 MPa. The working fluid is refrigerant-134a. The refrigerant leaves the condenser as a...

-

Classify each of the following as a horizontal merger, a vertical merger, a market extension merger, a conglomerate merger, or a product extension merger.

-

Dreher Companys balance sheet shows Inventory $162,800. What additional disclosures should be made?

-

A colleague has collected data from a sample of 80 students. He presents you with the following output from the statistical analysis software: LO9 Explain what this tells you about undergraduate and...

-

Jacobson Company issued $500,000 of 5-year, 8% bonds at 97 on January 1, 2012. The bonds pay interest twice a year. Instructions (a) (1) Prepare the journal entry to record the issuance of the bonds....

-

1.ABC Inc. issued $10,000,000 worth of bonds on January 14, 2018. The bonds mature on December 31, 2022 and carry a coupon rate of 8% payable semi-annually on June 30 and December 31" of each year. A...

-

In this exercise, simulate radioactive decay by studying the outcome of coin tosses. Procedure Each coin toss that lands heads-up will represent an atom that does not decay, whereas a coin that lands...

-

Lindy Hardware does not expect costs to change dramatically and wants to use an inventory costing method that averages cost changes. Requirements 1. Which inventory costing method would best meet...

-

Lindy Hardware used the FIFO inventory costing method in 2025. Lindy Hardware plans to continue using the FIFO method in future years. Which accounting principle is most relevant to Lindy Hardwares...

-

For each of the following functions f, find the matrix representative of a linear transformation T £(R; R'") which satisfies a) f(x) = (x2, sinx)- b) f(x) = (ex, 3x, l - x2) c) f(x) = (1, 2, 3,...

-

Solve (c) 8 WI n=1 5 cos n N5

-

- Pierce Company reported net income of $160,000 with income tax expense of $19,000 for 2020. Depreciation recorded on buildings and equipment amounted to $80,000 for the year. Balances of the...

-

ABC Company had the following results as of 12/31/2020: ABC's hurdle rate is 10% CONTROLLABLE REVENUE CONTROLLABLE COST CONTROLLABLE ASSETS CONTROLLABLE INCOME 21. What is the division's margin? A....

-

A gray kangaroo can bound across a flat stretch of ground with each jump carrying it 10 m from the takeoff point. If the kangaroo leaves the ground at a 20 angle, what are its (a) takeoff speed and...

-

Since 1900, many new theories in physics have changed the way that physicists view the world. Create a presentation that will explain to middle school students why Quantum Mechanics is important, how...

-

Pitney Corporation manufactures two types of transpondersno. 156 and no. 157and applies manufacturing overhead to all units at the rate of $76.50 per machine hour. Production information follows. The...

-

What did Lennox gain by integrating their WMS, TMS, and labor management systems?

-

York Inc. had Retained Earnings of $60,000 at its fiscal year end on October 31, 2019. At that time, it had $75,000 in common shares and $20,000 in $2 preferred shares. During 2020, the company...

-

Zelda Solutions Inc. earned net income of $152,000 in 2020. The general ledger reveals the following figures: Preferred shares, $1.50, 10,000 authorized, 4,000 shares issued and outstanding...

-

The net income of Valente Inc. amounted to $3,750,000 for the year ended December 31, 2020. There were 200,000, $9.00 cumulative preferred shares throughout the year. At January 1, 2020, Valente Inc....

-

Use the failure probability and consequence scores shown in the table to determine the risk factor for the project. Maturity 0.2 Cost 0.5 Complexity 0.5 Schedule 0.1 Dependency 0.4 Reliability 0.2...

-

Heidi, age 61, has contributed $20,000 in total to her Roth 401(k) account over a six-year period. When her account was worth $50,000 and Heidi was in desperate need of cash, Heidi received a $30,000...

-

The liability for preferred dividends declared is recorded on the date of record. 1 point True False

Study smarter with the SolutionInn App