1.A 10-year, 10 per cent annual coupon, $1000 bond trades at a yield to maturity of 8...

Question:

1.A 10-year, 10 per cent annual coupon, $1000 bond trades at a yield to maturity of 8 per cent. The bond has a duration of 6.994 years. What is the modified duration of this bond? What is the practical value of calculating modified duration? Does modified duration change the result of using the duration relationship to estimate price sensitivity? LO 6.7

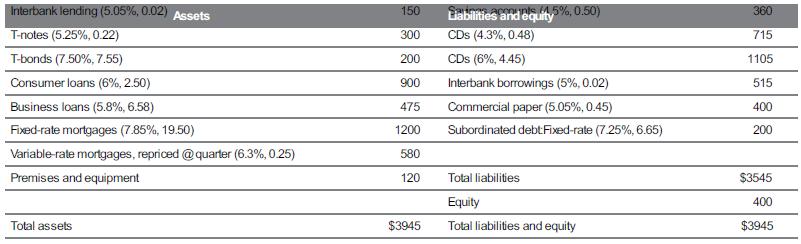

What is State Bank’s duration gap?

Use these duration values to calculate the expected change in the value of the assets and liabilities of State Bank for the predicted increase of 1.5 per cent in interest rates.

What is the change in equity value forecasted from the duration values for the predicted increase in interest rates of 1.5 per cent?

Step by Step Answer:

Financial Institutions Management A Risk Management

ISBN: 9781743073551

4th Edition

Authors: Helen Lange, Anthony Saunders, Marcia Millon Cornett