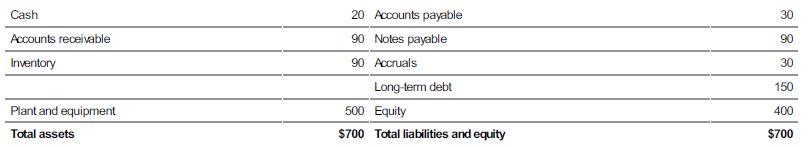

1.MNO Inc., a publicly traded manufacturing firm, has provided the following financial information in its application for...

Question:

1.MNO Inc., a publicly traded manufacturing firm, has provided the following financial information in its application for a loan.

Also assume sales = $500, cost of goods sold = $360, taxes = $56, interest payments = $40 and net income = $44; the dividend payout ratio is 50 per cent and the market value of equity is equal to the book value.

What is the Altman discriminant function value for MNO Inc.? Recall that:

Net working capital = Current assets minus current liabilities Current assets = Cash + accounts receivable + inventories Current liabilities = Accounts payable + accruals + notes payable EBIT = Revenues − Cost of goods sold − Depreciation Taxes = (EBIT − interest) (Tax rate)

Net income = EBIT − Interest − Taxes Retained earnings = Net income (1 − Dividend payout ratio)

Should you approve MNO’s application to your bank for a $500 capital expansion loan?

If sales for MNO were $300, the market value of equity was only half of book value, and the cost of goods sold and interest were unchanged, what would be the net income for MNO? Assume the tax credit can be used to offset other tax liabilities incurred by other divisions of the firm. Would your credit decision change?

Would the discriminant function change for firms in different industries? Would the function be different for retail lending in different geographic sections of the country? What are the implications for the use of these types of models by FIs? LO 10.9

Step by Step Answer:

Financial Institutions Management A Risk Management

ISBN: 9781743073551

4th Edition

Authors: Helen Lange, Anthony Saunders, Marcia Millon Cornett