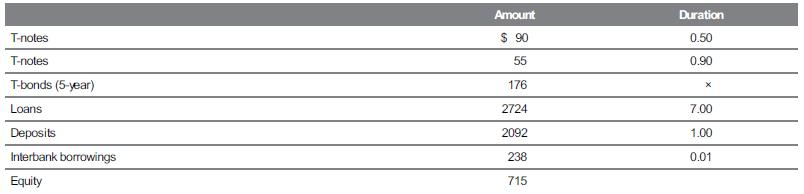

1.The following balance sheet information is available (amounts in thousands of dollars and duration in years) for...

Question:

1.The following balance sheet information is available (amounts in thousands of dollars and duration in years) for a financial institution:

Note that Treasury Bonds are five-year maturities paying 6 per cent semi-annually and selling at par.

What is the duration of the T-bond portfolio?

What is the average duration of all the assets?

What is the average duration of all the liabilities?

What is the leverage adjusted duration gap? What is the interest rate risk exposure?

What is the forecasted impact on the market value of equity caused by a relative upward shift in the entire yield curve of 0.5 per cent [i.e. ΔR /(1 + R ) = 0.0050]?

If the yield curve shifts downward by 0.25 per cent [i.e. ΔR /(1 + R ) = −0.0025], what is the forecasted impact on the market value of equity?

What variables are available to the financial institution to immunise the balance sheet? How much would each variable need to change to get DGAP equal to 0? LO 6.4

Step by Step Answer:

Financial Institutions Management A Risk Management

ISBN: 9781743073551

4th Edition

Authors: Helen Lange, Anthony Saunders, Marcia Millon Cornett