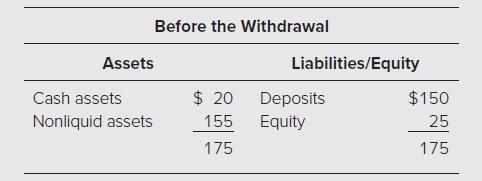

Consider the simple FI balance sheet below ($ millions). Before the Withdrawal Assets Liabilities/Equity Cash assets $

Question:

Consider the simple FI balance sheet below ($ millions).

Before the Withdrawal Assets Liabilities/Equity Cash assets $ 20 Deposits $ 150 Nonliquid assets 155 Equity 25 175 175 Suppose that depositors unexpectedly withdraw \($50\) million in deposits and the FI receives no new deposits to replace them. Assume that the FI cannot borrow any more funds in the short-term money markets, and because it cannot wait to get better prices for its assets in the future (as it needs the cash now to meet immediate depositor withdrawals), the FI has to sell any nonliquid assets at 75 cents on the dollar. Show the FI’s balance sheet after adjustments are made for the \($50\) million of deposit withdrawals.

Step by Step Answer:

Financial Institutions Management A Risk Management Approach

ISBN: 9781266138225

11th International Edition

Authors: Anthony Saunders, Marcia Millon Cornett, Otgo Erhemjamts