Export Bank has a trading position in euros and Australian dollars. At the close of business on

Question:

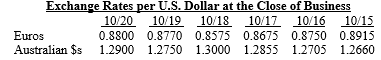

Export Bank has a trading position in euros and Australian dollars. At the close of business on October 20, the bank had €22 million and A$40 million. The exchange rates for the most recent six days are given below:

a. What is the foreign exchange (FX) position in dollar equivalents using the FX rates on October 20?

b. What is the sensitivity of each FX position; that is, what is the value of delta for each currency on October 20?

c. What is the daily percentage change in exchange rates for each currency over the five-day period?

d. What is the total risk faced by the bank on each day? What is the worst-case day? What is the best-case day?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Institutions Management A Risk Management Approach

ISBN: 978-1259717772

9th edition

Authors: Anthony Saunders, Marcia Millon Cornett

Question Posted: