Hedge Row Bank has the following balance sheet (in millions): The duration of the assets is six

Question:

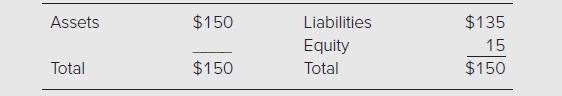

Hedge Row Bank has the following balance sheet (in millions):

The duration of the assets is six years and the duration of the liabilities is four years. The interest rate on both the assets and the liabilities is 10 percent. The bank is expecting interest rates to fall from 10 percent to 9 percent over the next year.

a. What is the duration gap for Hedge Row Bank?

b. What is the expected change in net worth for Hedge Row Bank if the forecast is accurate?

c. What will be the effect on net worth if interest rates increase 110 basis points?

d. If the existing interest rate on the liabilities is 6 percent, what will be the effect on net worth of a 1 percent increase in interest rates?

Step by Step Answer:

Financial Institutions Management A Risk Management Approach

ISBN: 9781266138225

11th International Edition

Authors: Anthony Saunders, Marcia Millon Cornett, Otgo Erhemjamts