Suppose that instead of funding the $200 million investment in 10 percent German loans with U.S. CDs,

Question:

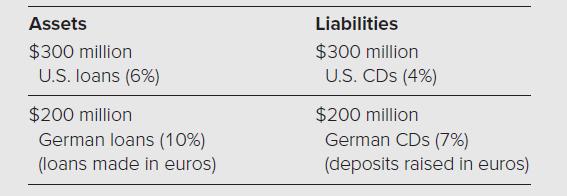

Suppose that instead of funding the $200 million investment in 10 percent German loans with U.S. CDs, the FI manager in problem 22 funds the German loans with $200 million equivalent one-year euro CDs at a rate of 7 percent.

Now the balance sheet of the FI would be as follows:

a. Calculate the return on the FI’s investment portfolio, the average cost of funds, and the net return for the FI if the spot foreign exchange rate falls to $1.15/€1 over the year.

b. Calculate the return on the FI’s investment portfolio, the average cost of funds, and the net return for the FI if the spot foreign exchange rate rises to $1.35/€1 over the year.

Step by Step Answer:

Financial Institutions Management A Risk Management Approach

ISBN: 9781266138225

11th International Edition

Authors: Anthony Saunders, Marcia Millon Cornett, Otgo Erhemjamts