Little Rollo works for the First National Bank. He is vice president in charge of the installment

Question:

Little Rollo works for the First National Bank. He is vice president in charge of the installment loan department. First National Bank has had many write-offs of bad installment loans during the past several years. As the internal auditor and fraud examiner, you have been assigned to investigate the installment loan manager to see if he has done anything wrong or unethical.

Using the various resources, you have found the following data. In several years, Little Rollo has a sudden increase in life style as presented below:

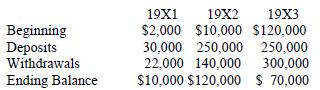

a. Little Rollo's personal bank account shows the following summary:

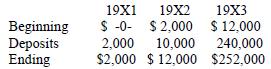

b. Little Rollo's personal savings account shows the following summary:

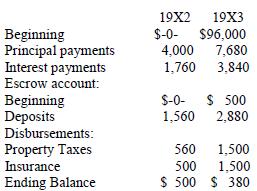

c. Little Rollo purchased a condominium in 19X2 for $200,000. The bank loaned Little Rollo $100,000 at 8% for 15 years. Principal and interest is $960 a month plus escrow payments of $240 a month. The purchase and mortgage was done on 7/1/19X2. The mortgage year-end statements shows the following:

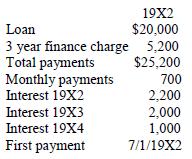

d. Little Rollo purchased a Sedan for $30,000 in 19X2. He financed the Sedan with the bank for $20,000. The installment loan contract showed the following:

e. The auto dealer allowed a trade-in allowance for Little Rollo's old car of $2,000. Little Rollo paid $6,000 for his old car in 19X0.

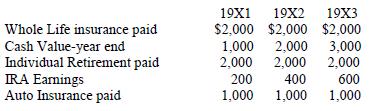

f. Little Rollo has the following accounts with his insurance salesman:

These are the payments and earnings for the periods shown.

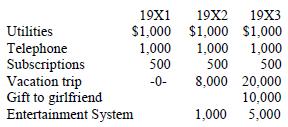

g. Little Rollo's checking account shows the following personal expenses:

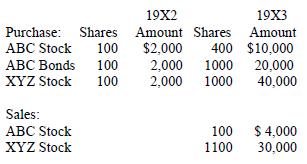

h. Little Rollo has a brokerage account with his stockbroker. The broker provided the following information:

i. The bank provides Little Rollo a corporate pension plan. The pension values are as follows:

19X1 .......................... $10,000

19X2 .......................... 14,000

19X3 .......................... 18,000

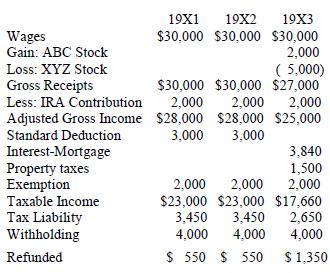

j. Little Rollo earns a salary of $30,000 a year during these periods.

k. Little Rollo filed tax returns as summarized below:

The refunds were made in the subsequent years. In addition, Little Rollo paid FICA taxes of $2,400 for each year above.

Using the above information, prepare RICO Expenditure Schedule for 19X2 and 19X3.

Step by Step Answer:

Financial Investigation And Forensic Accounting

ISBN: 9780367864347

3rd Edition

Authors: George A Manning