Balliol Ltd produces a tracking device that can be attached to bicycles. The device is designed to

Question:

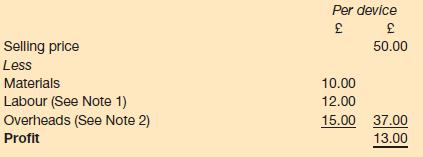

Balliol Ltd produces a tracking device that can be attached to bicycles. The device is designed to help locate the whereabouts of stolen bicycles and is sold to wholesalers and retailers throughout the UK. The following sales and cost data relating to the tracking device has been produced by the business:

Notes:

1. Labour is a fixed cost.

2. Two-thirds of overhead costs incurred are fixed.

In recent years, sales of the device have been stable at £20 million per year. However, a new chief executive has been appointed who is determined to increase sales. He commissioned a market research report, which indicates that sales could be increased by 20 per cent if a marketing campaign costing £1.5m per year is undertaken. The business has unused capacity within its factory and could easily cope with such an increase in sales.

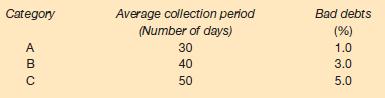

All sales are on credit and the business divides its customers into three separate categories according to their payment characteristics. The three categories are as follows:

If the marketing campaign is launched and the increase in sales achieved, 20 per cent of additional sales would be from Category A customers, 30 per cent Category B and 50percent from Category C customers. The business would finance any expansion in its trade receivables by a bank overdraft, on which it would expect to pay interest at 10 per cent per year.

All workings should be in £000s and should be made to one decimal place.

Required:

(a) What would be the effect of undertaking the marketing campaign on the annual profits before tax of the company, assuming the increase in sales is achieved?

(b) Briefly comment on the results of your finding in (a) above.

Step by Step Answer: