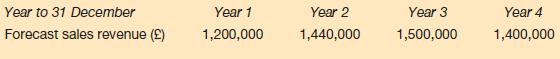

Eco-Energy Appliances Ltd started operations on 1 January and has produced the following forecasts for annual sales

Question:

Eco-Energy Appliances Ltd started operations on 1 January and has produced the following forecasts for annual sales revenue:

The following additional information is also available:

1. Operating profit is expected to be 15 per cent of sales revenue throughout the four-year period.

2. The company has an £800,000 10 per cent bank loan, half of which is redeemable at the end of Year 3.

3. The tax rate is expected to be 20 per cent throughout the four-year period. Tax is paid in the year following the year in which the relevant profits are made.

4. An initial investment in net working capital of £140,000 is required. Thereafter, investment in net working capital is expected to represent 10 per cent of sales revenue for the relevant year.

5. Depreciation of £70,000 per year must be charged for the non-current assets currently held.

6. Equipment costing £100,000 will be acquired at the beginning of Year 4. This will be depreciated at the rate of 10 per cent per year.

7. Dividends equal to 50 per cent of the profit for the year will be announced each year. These dividends are paid in the year following the period to which they relate.

8. The business has a current cash balance of £125,000.

Required:

Prepare projected cash flow statements of the business for each of the next four years.

Step by Step Answer: