Robinson plc is an international construction business that is based in the UK. The business expects to

Question:

Robinson plc is an international construction business that is based in the UK. The business expects to receive €10 million in six months’ time as the final payment for a bridge that the business recently completed in Germany. The senior executives of the business have been debating whether, and if so, how, to hedge against the foreign exchange risk associated with the receipt.

The euro has been falling against the £ sterling in recent months and some commentators believe that this trend will continue. Others believe, however, that the euro is likely to strengthen against the £ sterling in the near future as the eurozone economies begin to grow.

Faced with this uncertainty, the business is considering three possible options:

(i) To take out a currency option to hedge against the risk. An option is available from a bank at an exercise price of £1 = €1.20 and at a premium cost of £1.20 per €100.

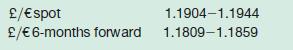

(ii) To take out a forward exchange contract. Exchange rates are:

(iii) To do nothing.

Required:

(a) Show the effect of each of the three options that are being considered, assuming that the exchange rate has moved in six months’ time to:

(i) £1 = €1.25

(ii) £1 = €1.15

(b) Discuss the results from (a) above.

Step by Step Answer: