Nimble Nursing Homes, Inc. owns an abandoned schoolhouse. The after tax value of the land is $600,000.

Question:

Nimble Nursing Homes, Inc. owns an abandoned schoolhouse. The after tax value of the land is $600,000. The furniture and fixtures of the school have been fully depreciated to an after tax market value of $50,000. The two options Nimble faces are either to sell the land and furniture/fixtures, or to convert the building into a nursing home. To refurbish and renovate the facility would cost

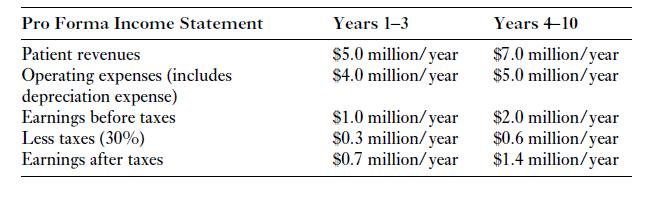

$30 million. The new building and equipment would be depreciated on a straight-line basis over a ten-year life to a $5 million salvage value. At the end of ten years, the land could be sold for an after tax value of $3 million. The new long-term care facility will have the pro forma income statement listed below for the next ten years. Net working capital will increase at a rate of $200,000 per year over the life of the project. Nimble Nursing Homes, Inc. has a 30 percent tax rate and has a required rate of return of 7 percent. Use both the NPV technique and IRR method to evaluate this project.

Step by Step Answer:

Financial Management Of Health Care Organizations

ISBN: 9780631230984

2nd Edition

Authors: William N. Zelman, Michael J. McCue, Alan R. Millikan, Noah D. Glick