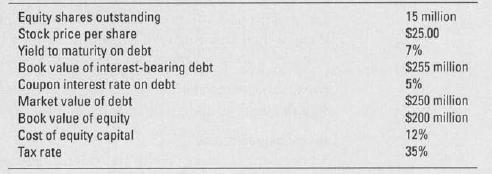

4. You have the following information about Burgundy Basins, a sink manufacturer.4. You have the following information

Question:

4. You have the following information about Burgundy Basins, a sink manufacturer.4. You have the following information about Burgundy Basins, a sink manufacturer.

Burgundy is contemplating what for the company is an average-risk investment costing $25 million and promising an annual after-tax cash flow of $3.5 million in perpetuity.

a. What is the internal rate of return on the investment?

b. What is Burgundy's weighted-average cost of capital?

c. If undertaken, would you expect this investment to benefit share- holders? Why or why not?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: