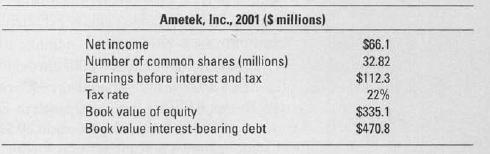

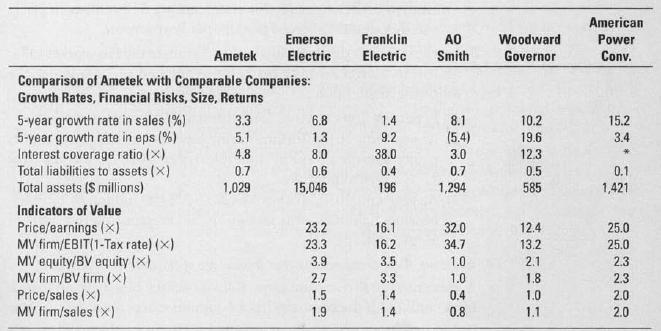

6. Ametek, Inc., is a billion dollar manufacturer of electronic instruments and motors headquartered in Paoli, Pennsylvania.

Question:

6. Ametek, Inc., is a billion dollar manufacturer of electronic instruments and motors headquartered in Paoli, Pennsylvania. Use the following information on Ametek and five other similar companies to value Ametek, Inc., on December 31, 2001.

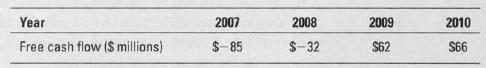

7. Following is a four-year forecast for Torino Marine.

a. Estimate the fair market value of Torino Marine at the end of 2006. Assume that after 2010, earnings before interest and tax will remain constant at $210 million, depreciation will equal capital expendi- tures in each year, and working capital will not change. Torino Marine's weighted-average cost of capital is 14 percent and its tax rate is 40 percent.

b. Estimate the fair market value per share of Torino Marine's equity at the end of 2006 if the company has 50 million shares outstanding and the market value of its interest-bearing liabilities on the valua- tion date equals $300 million.

c. Now let's try a different terminal value. Estimate the fair market value of Torino Marine's equity per share at the end of 2006 under the following assumptions: (1) Free cash flows in years 2007 through 2010 remain as above. (2) EBIT after year 2010 grows at 4 percent per year forever. (3) To support the perpetual growth in EBIT, capital expenditures in year 2011 exceed depreciation by $20 million, and this differ- ence grows 4 percent per year forever. (4) Similarly, working capital investments are $10 million in 2011, and this amount grows 4 percent per year forever.

d. Lastly, let's try a third terminal value. Estimate the fair market value of Torino Marine's equity per share at the end of 2006 under the following assumptions: (1) Free cash flows in years 2007 through 2010 remain as above. (2) At year-end 2010, Torino Marine has reached maturity, and its equity sells for a "typical" multiple of year 2010 net income. Use 17 as a typical multiple. (3) At year-end 2010, Torino Marine has $300 million of interest- bearing liabilities outstanding at an average interest rate of 10 percent.

Step by Step Answer: