Red Valley Breweries is considering an acquisition of Flagg Markets. Flagg currently has a cost of equity

Question:

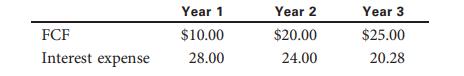

Red Valley Breweries is considering an acquisition of Flagg Markets. Flagg currently has a cost of equity of 10%; 25% of its financing is in the form of 6% debt, and the rest is in common equity. Its federal-plus-state tax rate is 40%. After the acquisition, Red Valley expects Flagg to have the following FCFs and interest payments for the next 3 years (in millions):

After this, the free cash flows are expected to grow at a constant rate of 5%, and the capital structure will stabilize at 35% debt with an interest rate of 7%.

a. What is Flagg’s unlevered cost of equity? What are its levered cost of equity and cost of capital for the post-horizon period?

b. Using the adjusted present value approach, what is Flagg’s value of operations to Red Valley?

Step by Step Answer: