Start with the partial model in the file Ch07 P15 Build a Model.xls on the textbook's website.

Question:

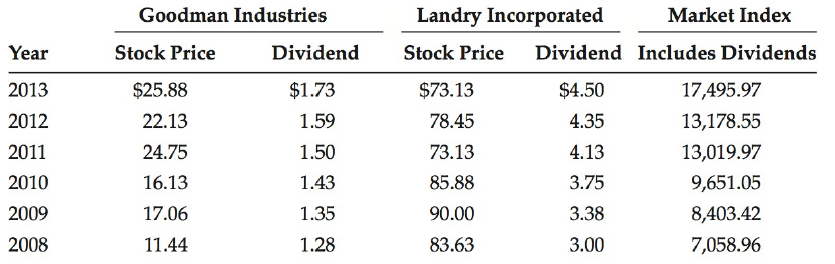

Start with the partial model in the file Ch07 P15 Build a Model.xls on the textbook's website. The file contains hypothetical data for working this problem. Goodman Industries's and Landry Incorporated's stock prices and dividends, along with the Market Index, are shown below. Stock prices are reported for December 31 of each year, and dividends reflect those paid during the year. The market data are adjusted to include dividends.

a. Use the data given to calculate annual returns for Goodman, Landry, and the Market Index, and then calculate average annual returns for the two stocks and the index.

b. Calculate the standard deviations of the returns for Goodman, Landry, and the Market Index.

c. Construct a scatter diagram graph that shows Goodman's returns on the vertical axis and the Market Index's returns on the horizontal axis. Construct a similar graph showing Landry's stock returns on the vertical axis.

d. Estimate Goodman's and Landry's betas as the slopes of regression lines with stock return on the vertical axis (y-axis) and market return on the horizontal axis (x-axis). Are these betas consistent with your graph?

e. The risk-free rate on long-term Treasury bonds is 6.04%. Assume that the market risk premium is 5%. What is the required return on the market? Now use the SML equation to calculate the two companies' required returns.

f. If you formed a portfolio that consisted of 50% Goodman stock and 50% Landry stock, what would be its beta and its required return?

g. Suppose an investor wants to include some Goodman Industries stock in his portfolio. Stocks A, B, and C are currently in the portfolio, and their betas are 0.769, 0.985, and 1.423, respectively. Calculate the new portfolio's required return if it consists of 25% Goodman, 15% Stock A, 40% Stock B, and 20% Stock C.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason