Start with the partial model in the file Ch13 P11 Build a Model.xls on the textbooks Web

Question:

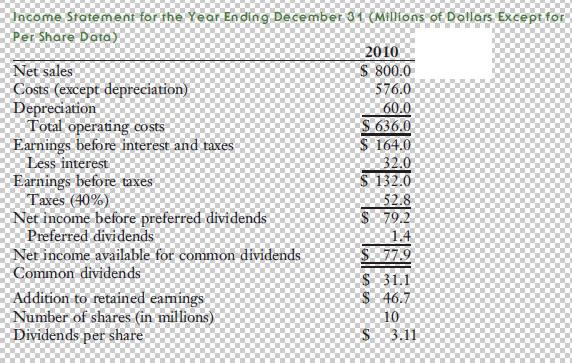

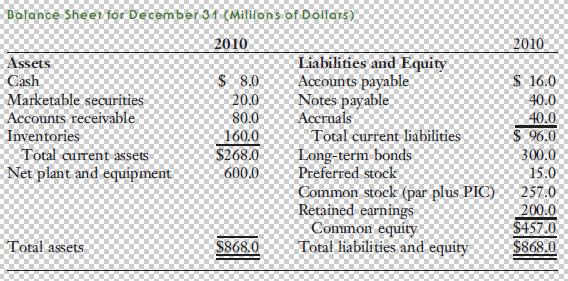

Start with the partial model in the file Ch13 P11 Build a Model.xls on the textbook’s Web site. The Henley Corporation is a privately held company specializing in lawn care products and services. The most recent financial statements are shown below.

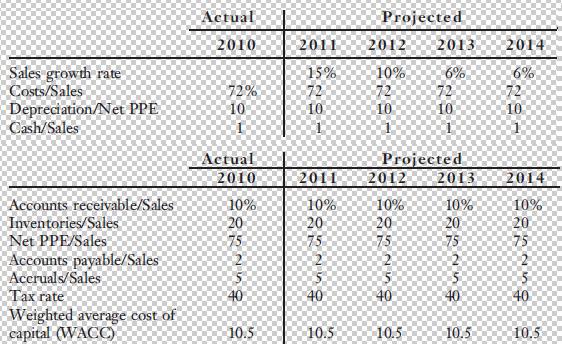

Projected ratios and selected information for the current and projected years are shown below.

a. Forecast the parts of the income statement and balance sheet that are necessary for calculating free cash flow.

b. Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure that there is constant growth (that is, the same as the constant growth rate in sales) by the end of the forecast period.

c. Calculate operating profitability (OP = NOPAT/Sales), capital requirements (CR = Operating capital/Sales), and expected return on invested capital (EROIC = Expected NOPAT/Operating capital at beginning of year). Based on the spread between EROIC and WACC, do you think that the company will have a positive Market Value Added (MVA = Market value of company − Book value of company = Value of operations − Operating capital)?

d. Calculate the value of operations and MVA. (Hint: First calculate the horizon value at the end of the forecast period, which is equal to the value of operations at the end of the forecast period.) Assume that the annual growth rate beyond the horizon is 6%.

e. Calculate the price per share of common equity as of 12/31/2010.

Step by Step Answer:

Financial management theory and practice

ISBN: 978-1439078099

13th edition

Authors: Eugene F. Brigham and Michael C. Ehrhardt