Stocks A and B have the following historical returns: a. Calculate the average rate of return for

Question:

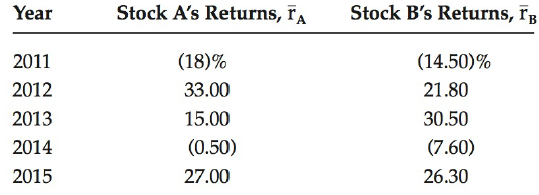

Stocks A and B have the following historical returns:

a. Calculate the average rate of return for each stock during the 5-year period.

b. Assume that someone held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period?

c. Calculate the standard deviation of returns for each stock and for the portfolio.

d. Calculate the coefficient of variation for each stock and for the portfolio.

e. If you are a risk-averse investor, would you prefer to hold Stock A, Stock B, or the portfolio? Why?

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason