You plan to invest in a hedge fund that has total capital of $200 million invested in

Question:

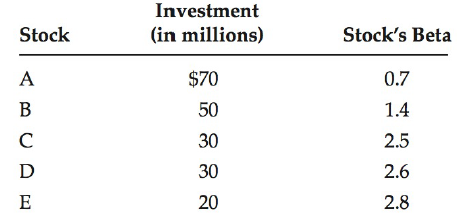

You plan to invest in a hedge fund that has total capital of $200 million invested in five stocks:

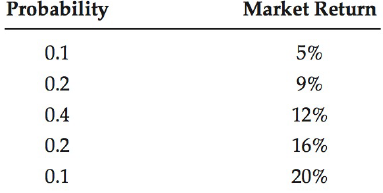

The risk-free rate is 4%, and you believe that the following probability distribution for future market returns is realistic:

The hedge fund receives a proposal from a company seeking new capital. The amount needed to take a position on the stock is $50 million. The stock has an expected return of 15%, and its estimated beta is 1.2.

a. What is the expected return on the hedge fund?

b. Should the hedge fund invest in the new company?

c. At what expected rate of return should the fund be indifferent to purchasing the stock?

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Expected Return

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason