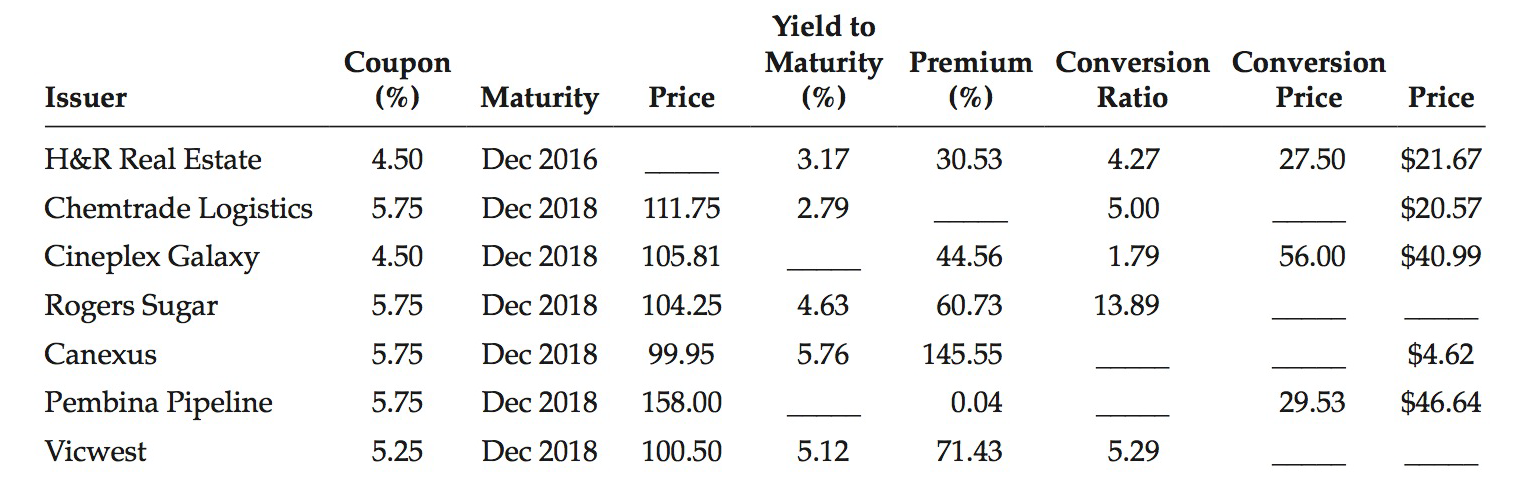

The table below provides market data from October 1, 2014, Solve for the unknown variables. The Premium

Question:

The table below provides market data from October 1, 2014, Solve for the unknown variables. The "Premium" column refers to the percentage extra an investor would pay for the stock if it purchased the bond at the market price and immediately converted at the conversion ratio. Assume that the bonds pay semiannually, that they mature at the end of the year shown, and that today is October 1, 2014. Thus the next payment will be in 3 months or 0.5 of a semiannual payment period. (Ignore any slight rounding.)

Yield to Maturity Premium Conversion Conversion Ratio Coupon (%) (%) Maturity (%) Price Issuer Price Price H&R Real Estate 4.50 Dec 2016 $21.67 3.17 30.53 4.27 27.50 Chemtrade Logistics 5.00 $20.57 5.75 Dec 2018 111.75 2.79 1.79 Cineplex Galaxy $40.99 4.50 Dec 2018 105.81 44.56 56.00 4.63 Rogers Sugar 5.75 Dec 2018 104.25 60.73 13.89 5.76 145.55 $4.62 Canexus 5.75 Dec 2018 99.95 Pembina Pipeline $46.64 5.75 Dec 2018 158.00 0.04 29.53 5.25 Vicwest Dec 2018 100.50 5.12 71.43 5.29

Step by Step Answer:

Coupon Maturity Price Yield Premium Conversion Ratio Conversion Price Stock Price HR Real Estate 450 ...View the full answer

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

Define each of the following terms: a. Working capital; net working capital; net operating working capital b. Inventory conversion period; receivables collection period; payables deferral period;...

-

Qbit Technology is considering changes in its working capital policies to improve its cash flow cycle. Qbit's sales last year were $3,250,000 (all on credit), and its net profit margin was 7%. Its...

-

A Government of Canada bond futures contract has a settlement price of 91.50. What is the implied annual yield?

-

Figure 6.6 shows the derivative g'. If g(0) = 0, graph g. Give (x, y)-coordinates of all local maxima and minima. -g'(x)- 2 6. -1 Figure 6.6 5

-

Let x0 (a) Construct and graph the natural cardinal splines corresponding to the nodes x0 = 0, x1 = 1, x2 = 2, and x3 =3. (b) Prove that the natural spline that interpolates the data yo,... ,yn can...

-

The Smart Manufacturing Company has a cycle time of 3.0 days, uses a Raw and In Process account and charges all conversion costs to Cost of Goods Sold. At the end of each month, all inventories are...

-

PLAN N IN G A N E W CAR P U RCH ASE. Olivia Green has just graduated from college and needs to buy a car to commute to work. She estimates that she can afford to pay about $450 per month for a loan...

-

Wheels, Inc. manufactures wheels for bicycles, tricycles, and scooters. For each cost given below, determine if the cost is a product cost or a period cost. If the cost is a product cost, further...

-

Exercise 18-07 Nordstrom, Inc. operates department stores in numerous states. Suppose selected financial statement data (in millions) for 2020 are presented below. End of Year $ 1,374 3,700 1,600...

-

A manufacturer of game controllers is concerned that its controller may be difficult for left-handed users. They set out to find lefties to test. About 13% of the population is left-handed. If they...

-

Tsetsekos Company was planning to finance an expansion. The principal executives of the company all agreed that an industrial company such as theirs should finance growth by means of common stock...

-

Memtech Ltd. needs to raise $15 million to construct production facilities for a new type of USB memory device. The firm's straight nonconvertible debentures currently yield 8%. Its stock sells for...

-

If one considers just the representative elements, how many groups would the periodic table have?

-

6) Do you find conditional probability problems challenging? Have you tried watching the videos on canvas and has it helped?

-

1. Determine the cost of heating 3 gallons of water (water weighs 8.33L per gallon ) at a room temperature of 22 degrees Celsius to the boiling point of 100 degrees Celsius at the energy rating of...

-

Writer One Inc. manufactures ball point pens that sell at wholesale for $0.80 per unit. Budgeted production in both 2018 and 2019 was 16,000 units. There was no beginning inventory in 2018. The...

-

1. A corn farmer has observed the following distribution for the number of ears of corn per cornstalk. Ears of Corn Probability 1 2 3 4 .3 .4 .2 .1 Part A: How many ears of corn does he expect on...

-

1. A mass m on a vertical spring with force constant k has an amplitude of A. Using the top of the motion as the origin for both gravitational potential energy and spring potential energy: (a) Find...

-

For the following exercises, let F(x) = (x + 1) 5 , f(x) = x 5 , and g(x) = x + 1. True or False: (f g )(x) = F(x).

-

Write an essay describing the differing approaches of nursing leaders and managers to issues in practice. To complete this assignment, do the following: 1. Select an issue from the following list:...

-

Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, and ships them to its chain of retail stores. Upton's balance sheet as of December 31, 2004,...

-

Stevens Textile's 2004 financial statements are shown below. Stevens Textile: Balance Sheet as of December 31, 2004 (Thousands of Dollars) Suppose 2005 sales are projected to increase by 15 percent...

-

Garlington Technologies Inc.'s 2004 financial statements are shown below. Garlington Technologies Inc.: Balance Sheet as of December 31, 2004 Suppose that in 2005 sales increase by 10 percent over...

-

How do warehouses and distribution centers differ? What is cross-docking and why might a company choose to cross-dock a product? What kinds of products can be delivered electronically? What kinds...

-

Strawberry Inc. has historically been an all-equity firm. The analyst expects EBIT to be $1.5B in perpetuity starting one year from now. The cost of equity for the company is 11.5% and the tax rate...

-

Guzman company received a 60- day, 5 % note for 54,000 dated July 12 from a customer on account. Determine the due date on note. Determine the maturity value of the note and journalize the entry of...

Study smarter with the SolutionInn App