Two companies, Shipton Ltd. and Falco Corporation, began operations with identical balance sheets. A year later, both

Question:

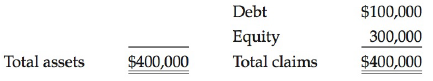

Two companies, Shipton Ltd. and Falco Corporation, began operations with identical balance sheets. A year later, both required additional manufacturing capacity at a cost of $100,000. Shipton obtained a 5-year, $100,000 loan at a 7% interest rate from its bank. Falco, on the other hand, decided to lease the required $100,000 capacity for 5 years, and a 7% return was built into the lease. The balance sheet for each company, before the asset increases, follows:

a. Show the balance sheets for both firms after the asset increases and calculate each firm's new debt ratio. (Assume that the lease is not capitalized.)

b. Show how Falco's balance sheet would look immediately after the financing if it capitalized the lease.

c. Would the rate of return (1) on assets and (2) on equity be affected by the choice of financing? How?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason