Yellowjacket Honey, Inc. is evaluating its cost of capital under alternative financing arrangements. In consultation with investment

Question:

Yellowjacket Honey, Inc. is evaluating its cost of capital under alternative financing arrangements. In consultation with investment bankers, Yellowjacket, Inc., expects to be able to issue new debt at par with a coupon rate of 10% and to issue new preferred stock with a

$4.00 per share dividend at $25 a share. The common stock of Yellowjacket is currently selling for $20.00 a share. Yellowjacket expects to pay a dividend of $2.50 per share next year. Market analysts foresee a growth in dividends in Invest stock at a rate of 5% per year.

Invest does not expect its cost of debt, preferred stock or common stock, to be different under the two possible financing arrangements.

Yellowjacket’s marginal tax rate is 40%.

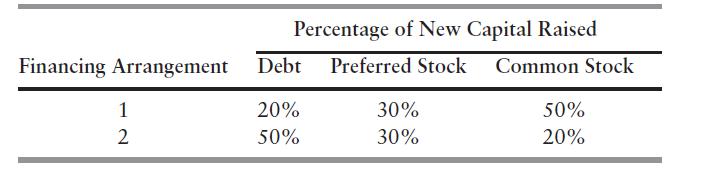

The two arrangements are:

What is the cost of capital to Yellowjacket Honey, Inc., under each financing arrangement?

Step by Step Answer:

Financial Management And Analysis (Frank J. Fabozzi Series)

ISBN: 9780471477617

2nd Edition

Authors: Frank J. Fabozzi, Pamela P. Peterson