Bellaire Inc. gathered the following data for use in developing the budgets for the first quarter (January,

Question:

Bellaire Inc. gathered the following data for use in developing the budgets for the first quarter (January, February, March) of its fiscal year:

a. Estimated sales at $125 per unit:

January . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,000 units

February . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,000 units

March. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,000 units

April. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50,000 units

b. Estimated finished goods inventories:

January 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,000 units

January 31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10% of next month’s sales

February 28. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10% of next month’s sales

March 31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10% of next month’s sales

c. Work in process inventories are estimated to be insignificant (zero).

d. Estimated direct materials inventories:

January 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000 lbs.

January 31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,500 lbs.

February 28. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,000 lbs.

March 31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,500 lbs.

e.

Manufacturing costs:.................................................................................................Per Unit

Direct materials (0.8 lb. per unit × $15 per lb.)..........................................................$12

Direct labor (2.5 hrs. per unit × $24 per hr.)..............................................................60

Variable factory overhead ($1.20 per direct labor hour)..........................................3

Fixed factory overhead ($200,000 per month, allocated using 40,000 units)........5

Total per-unit manufacturing costs $80

f. Selling expenses:

Variable selling expenses. . . . . . . . . . . . . . . . . . . . . . $4 per unit

Fixed selling expenses . . . . . . . . . . . . . . . . . . . . . . . . $150,000

Administrative expenses (all fixed costs). . . . . . . . . $400,000

Instructions

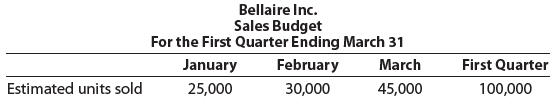

Prepare the following budgets using one column for each month and a total column for the first quarter, as shown for the sales budget:

1. Prepare a sales budget for March.

2. Prepare a production budget for March.

3. Prepare a direct materials purchases budget for March.

4. Prepare a direct labor cost budget for March.

5. Prepare a factory overhead cost budget for March.

6. Prepare a cost of goods sold budget for March.

7. Prepare a selling and administrative expenses budget for March.

8. Prepare a budgeted income statement with budgeted operating income for March.

Step by Step Answer:

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton