Question:

Den-Tex Company is evaluating a proposal to replace its HID (high intensity discharge) lighting with LED (light emitting diode) lighting throughout its warehouse. LED lighting consumes less power and lasts longer than HID lighting for similar performance. The following information was developed:

HID watt hour consumption per fixture 500 watts per hr.

LED watt hour consumption per fixture 300 watts per hr.

Number of fixtures 700

Lifetime investment cost (in present value terms) to replace each HID fixture with LED $500

Operating hours per day 10

Operating days per year 300

Metered utility rate per kilowatt-hour (kwh)* $0.11

*Note: A kilowatt-hour is equal to 1,000 watts per hour.

a. Determine the investment cost for replacing the 700 fixtures.

b. Determine the annual utility cost savings from employing the new energy solution.

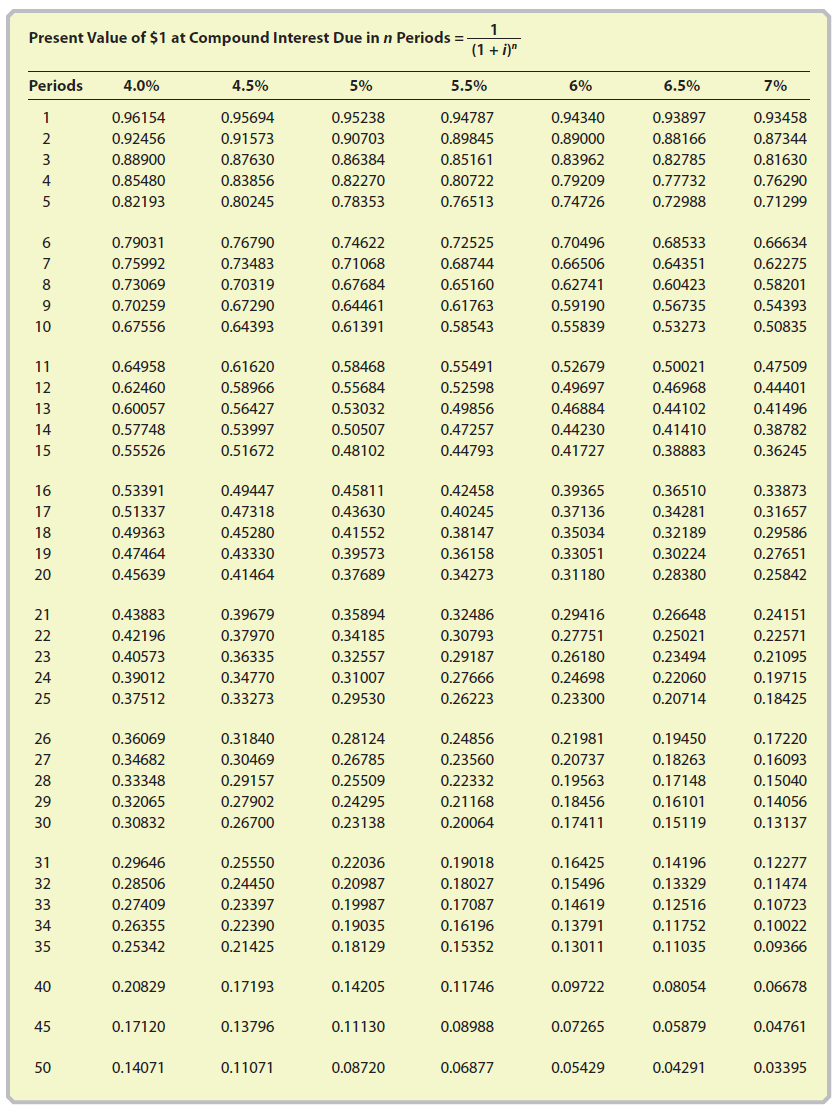

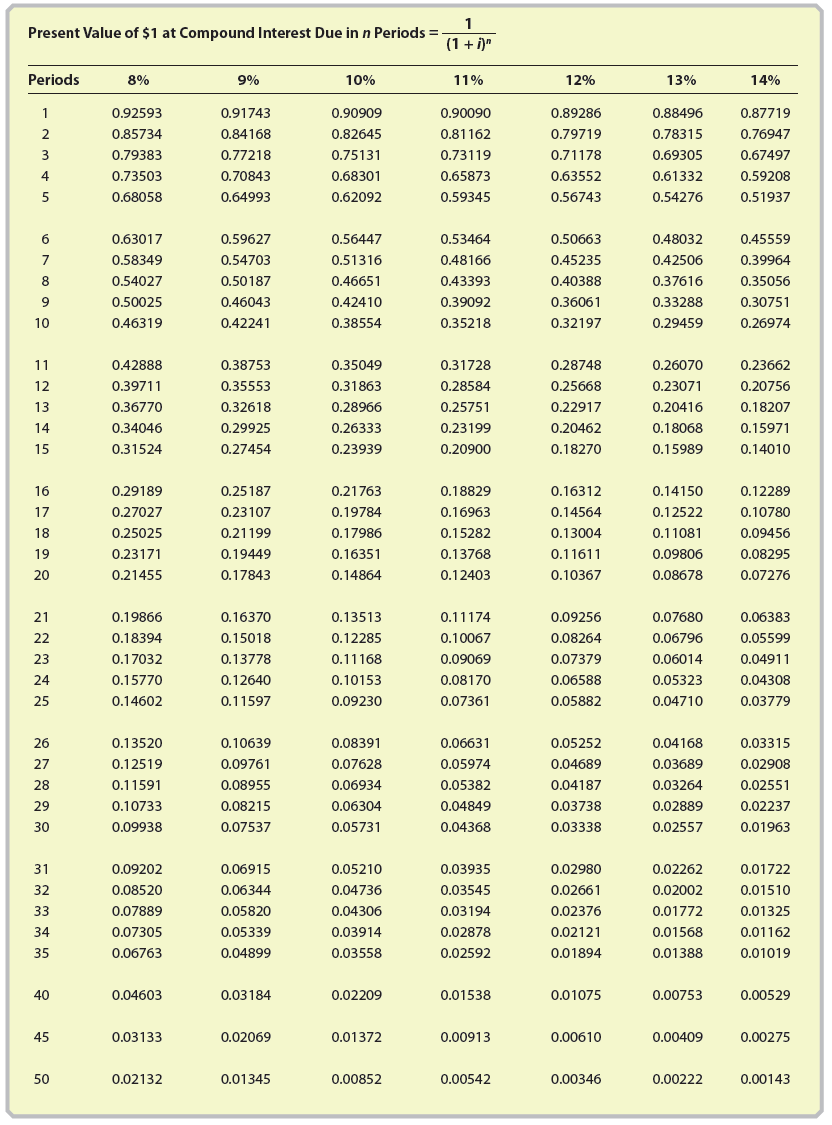

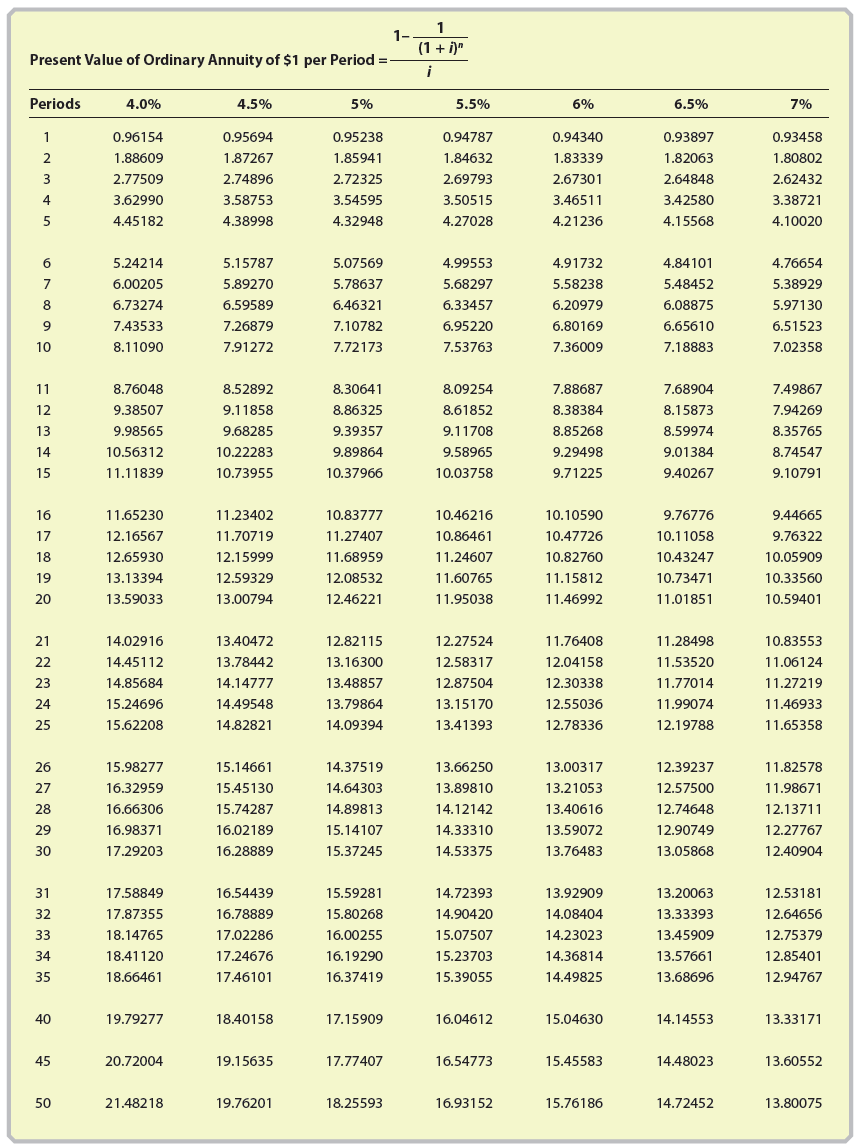

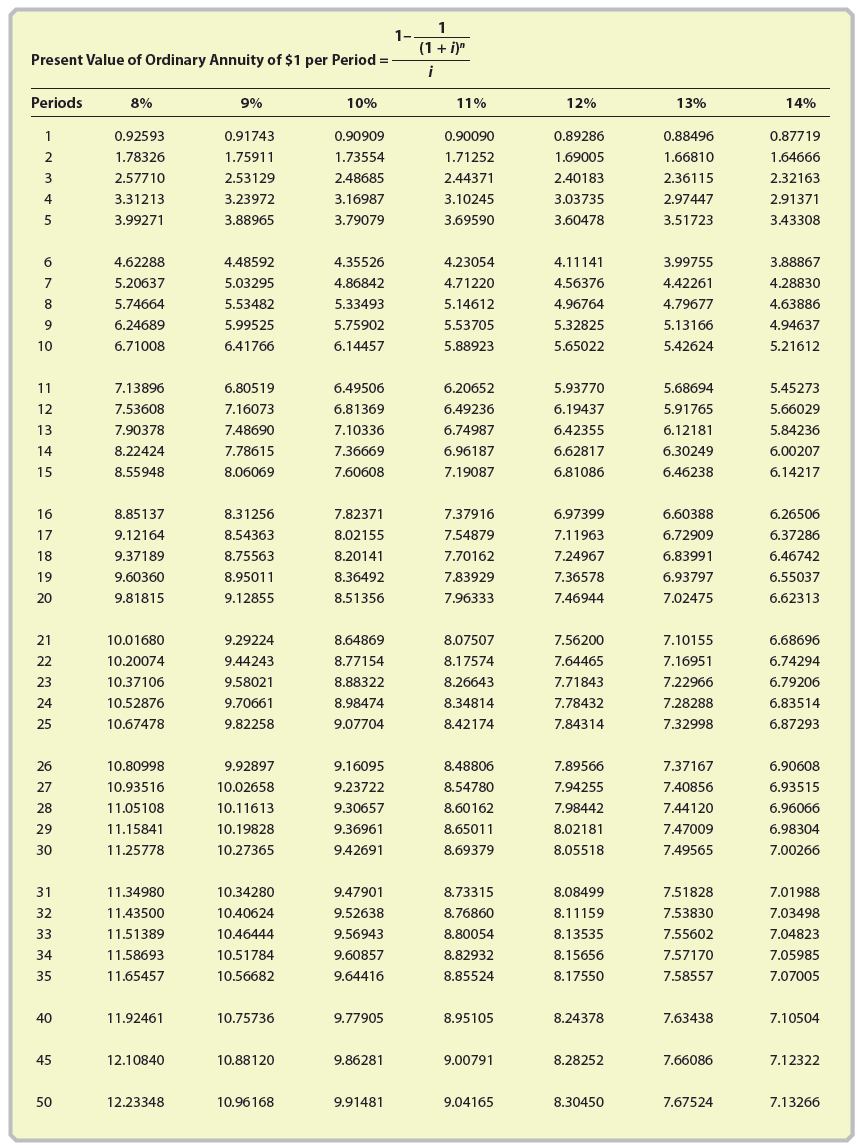

c. Should the proposal be accepted? Evaluate the proposal using net present value, assuming a 15-year life and 8% minimum rate of return. (Present value factors are available in Appendix A.)

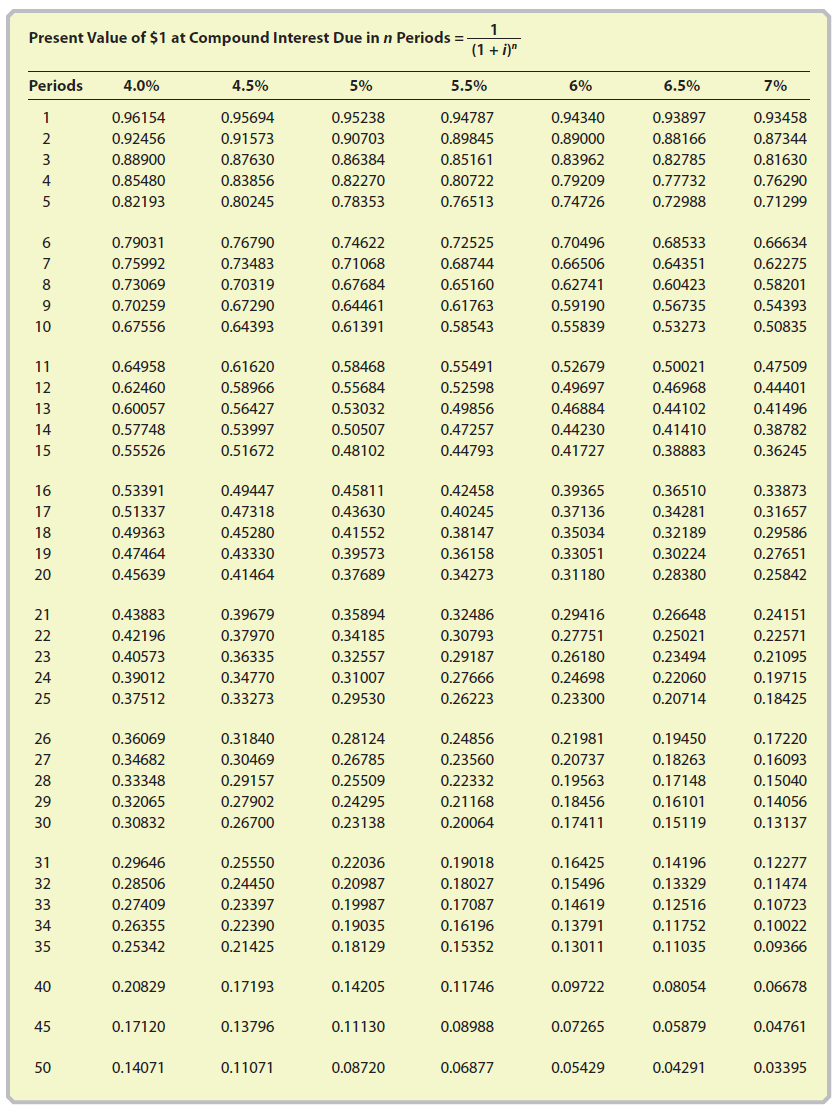

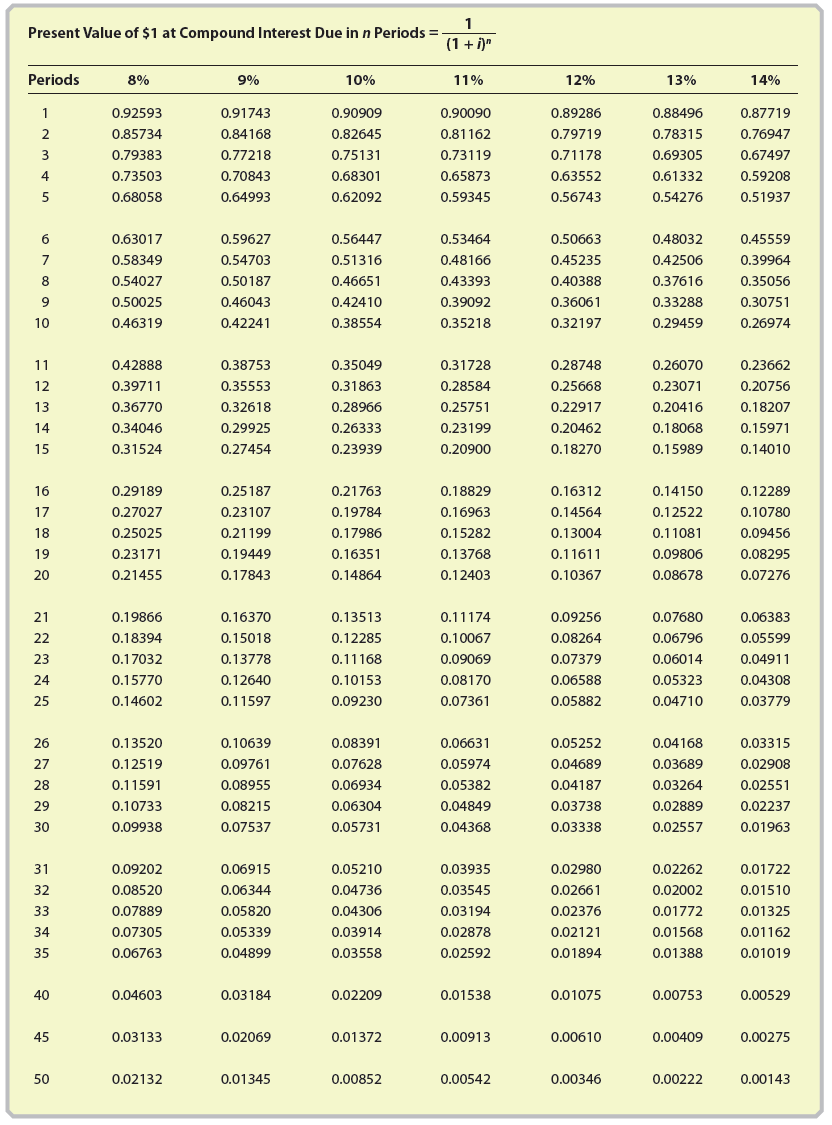

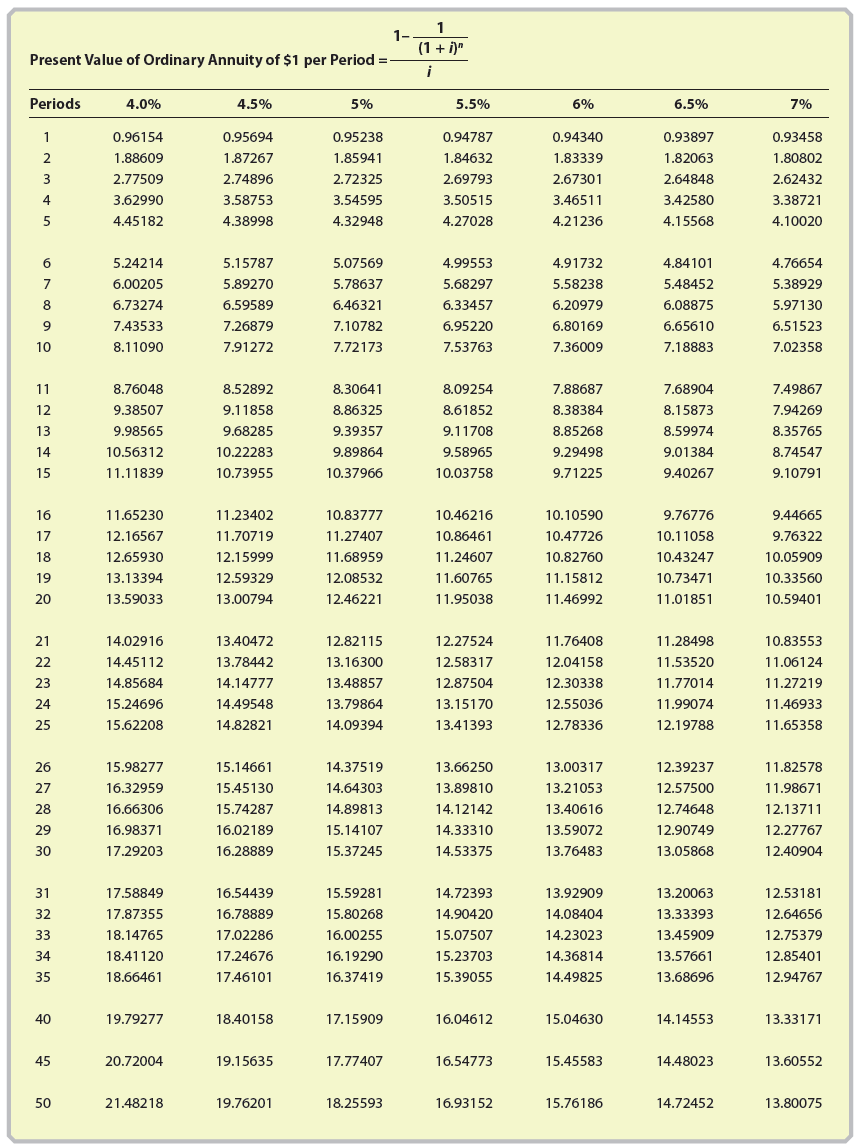

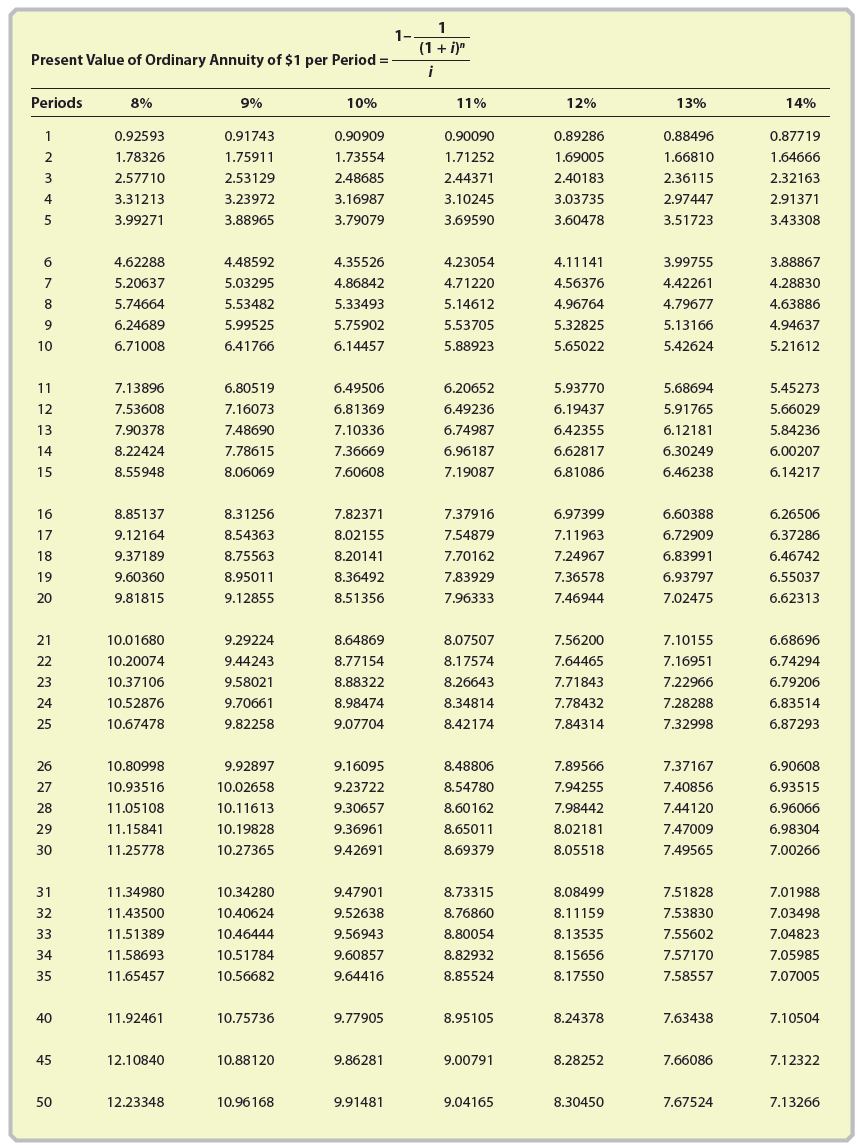

Appendix A:

Net Present Value

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Transcribed Image Text:

Present Value of $1 at Compound Interest Due in n Periods = (1 + i)" Periods 4.0% 4.5% 5% 5.5% 6% 6,5% 7% 0.94787 0.94340 0.93897 0.96154 0.95694 0.95238 0.93458 0.91573 0.90703 0.89000 0.92456 0.89845 0.88166 0.87344 0.87630 0.85161 0.83962 0.82785 0.88900 0.86384 0.81630 0.85480 0.83856 0.76290 0.82270 0.80722 0.79209 0.77732 0.78353 0.74726 0.71299 0.82193 0.80245 0.76513 0.72988 0.79031 0.72525 0.70496 0.66634 0.76790 0.74622 0.68533 0.75992 0.68744 0.66506 0.62275 0.73483 0.71068 0.64351 0.65160 0.73069 0.70319 0.67684 0.62741 0.60423 0.58201 0.56735 0.64461 0.61763 0.70259 0.67290 0.59190 0.54393 0.67556 0.61391 0.58543 0.53273 0.50835 10 0.64393 0.55839 11 0.64958 0.61620 0.58468 0.55491 0.52679 0.50021 0.47509 0.62460 0.49697 0.44401 12 0.58966 0.55684 0.52598 0.46968 0.60057 0.46884 13 0.56427 0.53032 0.49856 0.44102 0.41496 0.47257 0.44230 0.41410 14 0.57748 0.53997 0.50507 0.38782 0.51672 0.44793 15 0.55526 0.48102 0.41727 0.38883 0.36245 16 0.53391 0.49447 0.45811 0.42458 0.39365 0.36510 0.33873 0.37136 0.47318 0.43630 0.40245 0.31657 17 0.51337 0.34281 0.45280 0.38147 18 0.49363 0.41552 0.35034 0.32189 0.29586 0.33051 19 0.47464 0.43330 0.39573 0.36158 0.30224 0.27651 0.41464 0.34273 0.31180 0.25842 20 0.45639 0.37689 0.28380 0.35894 0.32486 0.24151 21 0.43883 0.39679 0.29416 0.26648 0.27751 0.25021 0.34185 0.30793 0.22571 22 0.42196 0.37970 0.40573 23 0.36335 0.32557 0.29187 0.26180 0.23494 0.21095 0.24698 24 0.39012 0.34770 0.31007 0.27666 0.22060 0.19715 0.33273 0.26223 25 0.37512 0.29530 0.23300 0.20714 0.18425 0.31840 0.24856 26 0.36069 0.28124 0.21981 0.19450 0.17220 0.20737 27 0.34682 0.30469 0.26785 0.23560 0.18263 0.16093 0.22332 0.19563 0.15040 28 0.33348 0.29157 0.25509 0.17148 0.21168 29 0.32065 0.27902 0.24295 0.18456 0.16101 0.14056 0.26700 0.23138 0.20064 0.17411 0.13137 30 0.30832 0.15119 0.14196 31 0.29646 0.25550 0.22036 0.19018 0.16425 0.12277 0.18027 32 0.28506 0.24450 0.20987 0.15496 0.13329 0.11474 0.23397 0.19987 33 0.27409 0.17087 0.14619 0.12516 0.10723 0.19035 0.16196 0.11752 34 0.26355 0.22390 0.13791 0.10022 35 0.25342 0.21425 0.18129 0.15352 0.13011 0.11035 0.09366 0.14205 40 0.20829 0.17193 0.11746 0.09722 0.08054 0.06678 0.17120 0.07265 45 0.13796 0.11130 0.08988 0.05879 0.04761 0.14071 0.11071 0.05429 0.04291 50 0.08720 0.06877 0.03395 Present Value of $1 at Compound Interest Due in n Periods = (1 + i)" Periods 8% 9% 10% 11% 12% 13% 14% 0.92593 0.91743 0.90909 0.90090 0.89286 0.88496 0.87719 2 0.85734 0.84168 0.82645 0.81162 0.79719 0.78315 0.76947 3 0.79383 0.77218 0.75131 0.73119 0.71178 0.69305 0.67497 4 0.73503 0.70843 0.68301 0.65873 0.63552 0.61332 0.59208 0.68058 0.64993 0.62092 0.59345 0.56743 0.54276 0.51937 0.63017 0.59627 0.56447 0.53464 0.50663 0.48032 0.45559 0.58349 0.54703 0.51316 0.48166 0.45235 0.42506 0.39964 8 0.54027 0.50187 0.46651 0.43393 0.40388 0.37616 0.35056 0.50025 0.46043 0.42410 0.39092 0.36061 0.33288 0.30751 10 0.46319 0.42241 0.38554 0.35218 0.32197 0.29459 0.26974 11 0.42888 0.38753 0.35049 0.31728 0.28748 0.26070 0.23662 12 0.39711 0.35553 0.31863 0.28584 0.25668 0.23071 0.20756 13 0.36770 0.32618 0.28966 0.25751 0.22917 0.20416 0.18207 14 0.34046 0.29925 0.26333 0.23199 0.20462 0.18068 0.15971 15 0.31524 0.27454 0.23939 0.20900 0.18270 0.15989 0.14010 16 0.29189 0.25187 0.21763 0.18829 0.16312 0.14150 0.12289 17 0.27027 0.23107 0.19784 0.16963 0.14564 0.12522 0.10780 18 0.25025 0.21199 0.17986 0.15282 0.13004 0.11081 0.09456 19 0.23171 0.19449 0.16351 0.13768 0.11611 0.09806 0.08295 20 0.21455 0.17843 0.14864 0.12403 0.10367 0.08678 0.07276 21 0.19866 0.16370 0.13513 0.11174 0.09256 0.07680 0.06383 22 0.18394 0.15018 0.12285 0.10067 0.08264 0.06796 0.05599 23 0.17032 0.13778 0.11168 0.09069 0.07379 0.06014 0.04911 24 0.15770 0.12640 0.10153 0.08170 0.06588 0.05323 0.04308 25 0.14602 0.11597 0.09230 0.07361 0.05882 0.04710 0.03779 26 0.13520 0.10639 0.08391 0.06631 0.05252 0.04168 0.03315 27 0.12519 0.09761 0.07628 0.05974 0.04689 0.03689 0.02908 28 0.11591 0.08955 0.06934 0.05382 0.04187 0.03264 0.02551 29 0.10733 0.08215 0.06304 0.04849 0.03738 0.02889 0.02237 30 0.09938 0.07537 0.05731 0.04368 0.03338 0.02557 0.01963 31 0.09202 0.06915 0.05210 0.03935 0.02980 0.02262 0.01722 32 0.08520 0.06344 0.04736 0.03545 0.02661 0.02002 0.01510 33 0.07889 0.05820 0.04306 0.03194 0.02376 0.01772 0.01325 34 0.07305 0.05339 0.03914 0.02878 0.02121 0.01568 0.01162 35 0.06763 0.04899 0.03558 0.02592 0.01894 0.01388 0.01019 40 0.04603 0.03184 0.02209 0.01538 0.01075 0.00753 0.00529 45 0.03133 0.02069 0.01372 0.00913 0.00610 0.00409 0.00275 50 0.02132 0.01345 0.00852 0.00542 0.00346 0.00222 0.00143