Semi Truck Sales Company (STS Company) buys large trucks from the manufacturer and sells them to companies

Question:

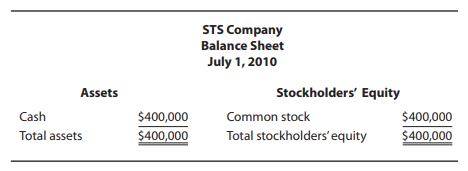

Semi Truck Sales Company (STS Company) buys large trucks from the manufacturer and sells them to companies and independent truckers who haul goods over long distances. STS has been successful in this niche of the industry. Because of the high cost of the trucks and of financing inventory, STS tries to maintain as small an inventory as possible. In fact, at the beginning of July the company had no inventory or liabilities, as shown on the balance sheet on the next page.

On July 9, STS took delivery of a truck at a price of $150,000. On July 19, an identical truck was delivered to the company at a price of $160,000. On July 28, the company sold one of the trucks for $195,000. During July, expenses totaled $15,000. All transactions were paid in cash.

1. Prepare income statements and balance sheets for STS on July 31 using (a) the FIFO method of inventory valuation and (b) the LIFO method of inventory valuation. Assume an income tax rate of 40 percent. Explain the effects of each method on the financial statements.

2. Assume that the management of STS Company has a policy of declaring a cash dividend each period that is exactly equal to net income. What effects does this action have on each balance sheet prepared in requirement 1? How do the resulting balance sheets compare with the balance sheet at the beginning of the month? Which inventory method, if either, do you feel is more realistic in representing STS’s income?

3. Assume that STS receives notice of another price increase of $10,000 on trucks, to take effect on August 1. How does this information relate to management’s dividend policy, and how will it affect next month’s operations?

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1439037805

9th edition

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson