Answered step by step

Verified Expert Solution

Question

1 Approved Answer

create their own business and account for their business operations. Business ideas and accounting knowledge for a partnership business is the fundamental part of

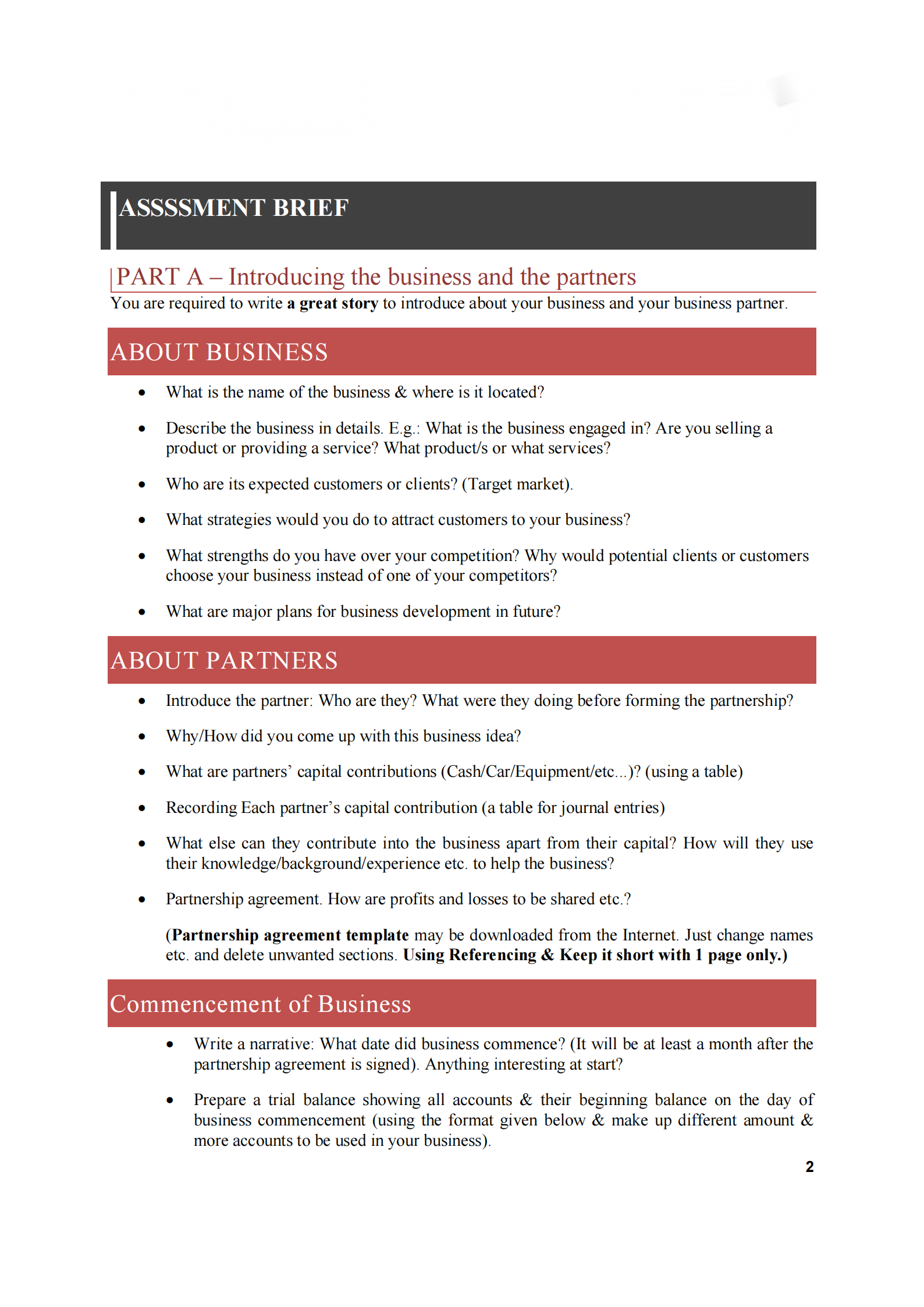

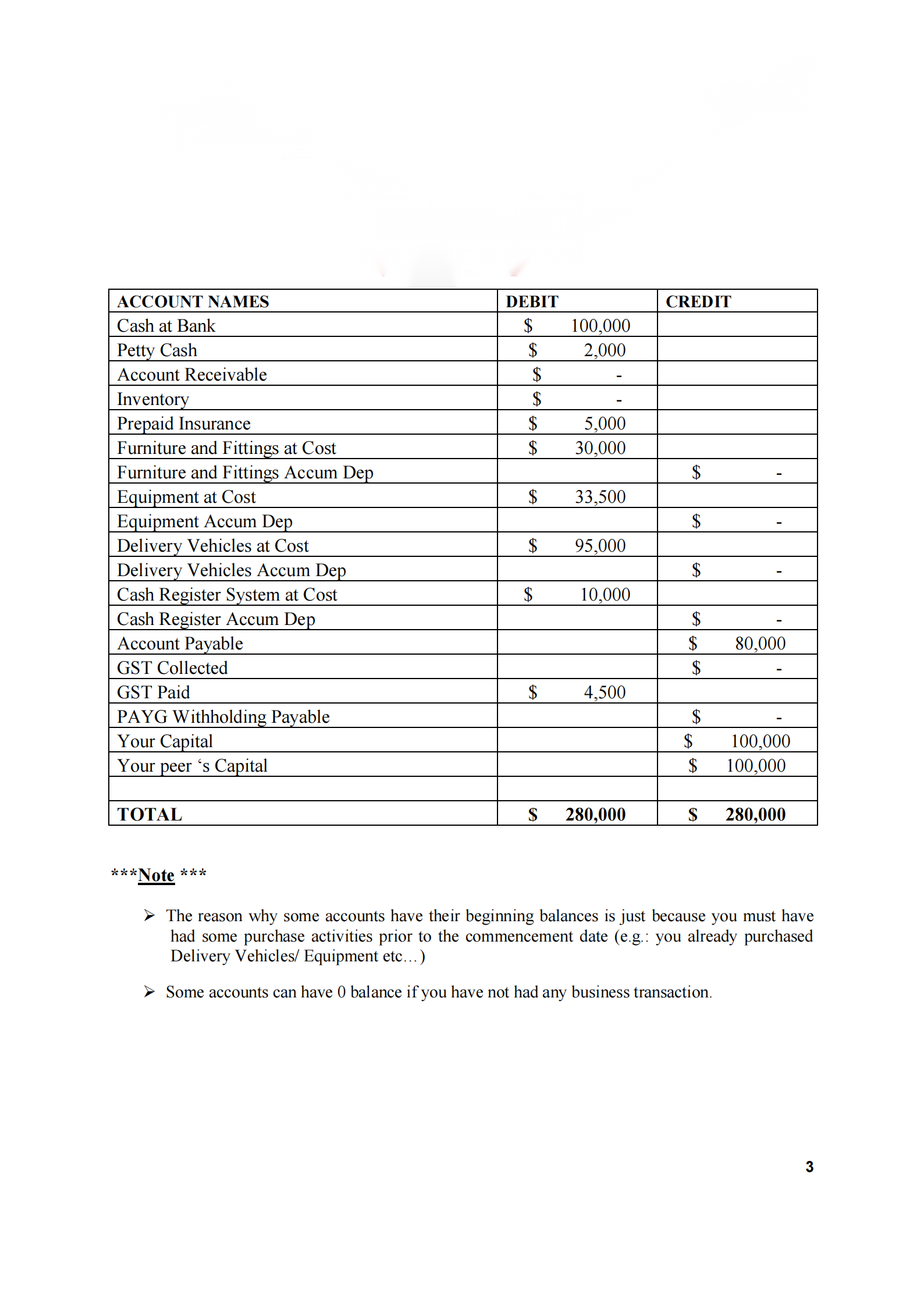

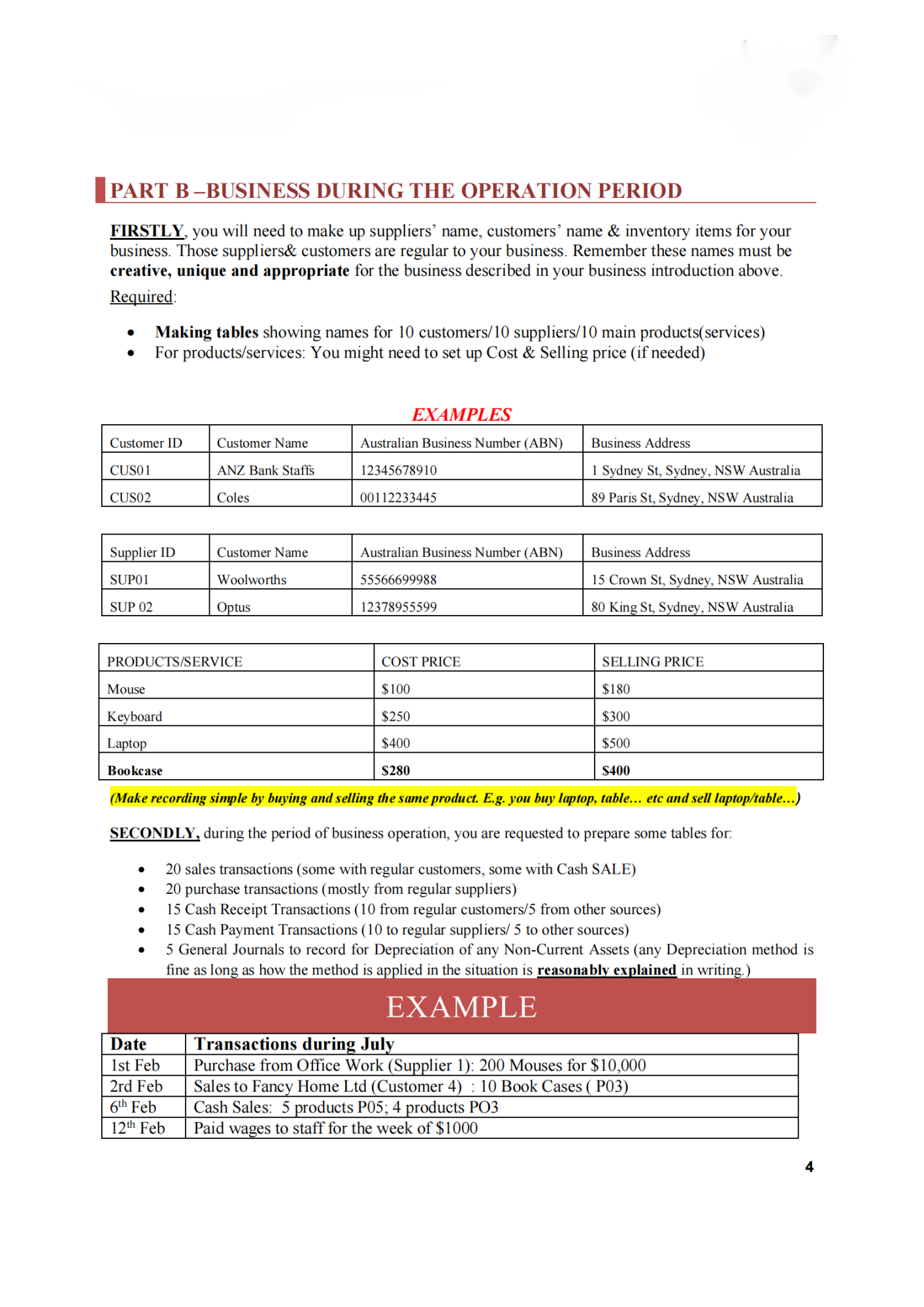

create their own business and account for their business operations. Business ideas and accounting knowledge for a partnership business is the fundamental part of the assessment. In addition, students are required to use the set of technical skills including the use of accounting application MYOB to record for their business transactions and Excel spreadsheet to prepare for NCA's Depreciation Schedule. The successful completion of this task will demonstrate that students have a strong understanding of business concepts and accounting principles applied in real business context, as well as the ability to use the computer accounting system. LEARNING OUTCOMES SLO 1: Demonstrate the process of recording economic events in accounting information system SLO 3: Identify and address the practical issues in accounting for assets. ASSSSMENT BRIEF PART A - Introducing the business and the partners You are required to write a great story to introduce about your business and your business partner. ABOUT BUSINESS ABOUT PARTNERS Introduce the partner: Who are they? What were they doing before forming the partnership? Why/How did you come up with this business idea? What are partners' capital contributions (Cash/Car/Equipment/etc...)? (using a table) Recording Each partner's capital contribution (a table for journal entries) What else can they contribute into the business apart from their capital? How will they use their knowledge/background/experience etc. to help the business? Partnership agreement. How are profits and losses to be shared etc.? (Partnership agreement template may be downloaded from the Internet. Just change names etc. and delete unwanted sections. Using Referencing & Keep it short with 1 page only.) Commencement of Business Write a narrative: What date did business commence? (It will be at least a month after the partnership agreement is signed). Anything interesting at start? What is the name of the business & where is it located? Describe the business in details. E.g.: What is the business engaged in? Are you selling a product or providing a service? What product/s or what services? Who are its expected customers or clients? (Target market). What strategies would you do to attract customers to your business? What strengths do you have over your competition? Why would potential clients or customers choose your business instead of one of your competitors? What are major plans for business development in future? Prepare a trial balance showing all accounts & their beginning balance on the day of business commencement (using the format given below & make up different amount & more accounts to be used in your business). 2 ACCOUNT NAMES Cash at Bank Petty Cash Account Receivable Inventory Prepaid Insurance Furniture and Fittings at Cost Furniture and Fittings Accum Dep Equipment at Cost Equipment Accum Dep Delivery Vehicles at Cost Delivery Vehicles Accum Dep Cash Register System at Cost Cash Register Accum Dep Account Payable GST Collected GST Paid PAYG Withholding Payable Your Capital Your peer 's Capital TOTAL *Note *** **** DEBIT $ $ $ $ $ $ $ $ 33,500 $ 100,000 2,000 $ 5,000 30,000 95,000 10,000 4,500 $ 280,000 CREDIT $ $ $ $ $ $ $ $ $ 80,000 100,000 100,000 $ 280,000 The reason why some accounts have their beginning balances is just because you must have had some purchase activities prior to the commencement date (e.g.: you already purchased Delivery Vehicles/ Equipment etc...) Some accounts can have 0 balance if you have not had any business transaction. 3 PART B-BUSINESS DURING THE OPERATION PERIOD FIRSTLY, you will need to make up suppliers' name, customers' name & inventory items for your business. Those suppliers& customers are regular to your business. Remember these names must be creative, unique and appropriate for the business described in your business introduction above. Required: Making tables showing names for 10 customers/10 suppliers/10 main products(services) For products/services: You might need to set up Cost & Selling price (if needed) Customer ID CUS01 CUS02 Supplier ID SUP01 SUP 02 Customer Name ANZ Bank Staffs Coles Customer Name Woolworths Date 1st Feb 2rd Feb 6th Feb 12th Feb Optus PRODUCTS/SERVICE EXAMPLES Australian Business Number (ABN) 12345678910 00112233445 Australian Business Number (ABN) 55566699988 12378955599 SELLING PRICE Mouse $180 Keyboard $300 Laptop $500 Bookcase $400 (Make recording simple by buying and selling the same product. E.g. you buy laptop, table.. etc and sell laptop/table...) SECONDLY, during the period of business operation, you are requested to prepare some tables for: 20 sales transactions (some with regular customers, some with Cash SALE) 20 purchase transactions (mostly from regular suppliers) 15 Cash Receipt Transactions (10 from regular customers/5 from other sources) 15 Cash Payment Transactions (10 to regular suppliers/ 5 to other sources) 5 General Journals to record for Depreciation of any Non-Current Assets (any Depreciation method is fine as long as how the method is applied in the situation is reasonably explained in writing.) EXAMPLE Business Address 1 Sydney St, Sydney, NSW Australia 89 Paris St, Sydney, NSW Australia COST PRICE $100 $250 $400 $280 Business Address 15 Crown St, Sydney, NSW Australia 80 King St, Sydney, NSW Australia Transactions during July Purchase from Office Work (Supplier 1): 200 Mouses for $10,000 Sales to Fancy Home Ltd (Customer 4): 10 Book Cases (P03) Cash Sales: 5 products P05; 4 products PO3 Paid wages to staff for the week of $1000 4 PART C-USE MYOB TO RECORD TRANSACTIONS FROM PART B Learning resources on how to use MYOB are provided under the bottom of Module page in Canvas. After the completion of recording, you are required to generate those reports from MYOB: General Journal Transaction Journal Sales and Receivable Transaction Journal Purchase and Payable Transaction Journal Cash Disbursement Transaction Journals Cash Receipts Transaction Journals Standard Balance Sheet Profit and Loss Statement (Accrual) PART D-ANALYSE THE BUSINESS PERFORMANCE Financial Statement Analysis and Ratio Analysis are commonly used to produce information on the business performance and therefore it helps to identify the problems early so that the prompt decisions can be made to correct the problems and improve the business performance. Your pair is required to use the reports obtained from MYOB to demonstrate some analysis to draw information on your business performance during the period of business operation. Your calculations and writing should be well developed in a structure of analysing business performance based on 4 main categories: Profitability Liquidity Efficiency Solvency Finally, you might need to provide some suggestions (future plans) to improve the business performance in the future if you believe that your business is currently facing some problems given your analysis. PART E-DEPRECIATION SCHEDULE FOR NON-CURRENT ASSET You are required to select ONE (1) depreciating Non-Current Asset from your Balance Sheet to complete the following tasks: O Clearly explain the depreciation method used to determine the its depreciation expense for this business operation period. O Using Excel to construct Depreciation Schedule for this NCA over 3-5-year period under both methods: Straight-line & Reducing balance (at double S-L rate) O Draw graphs on NCA's depreciation & Book Value to make a comparison between two methods. O Explain the key findings for differences between Straight-line & Reducing balance in accounting for the NCA's depreciation and Book Value 5 SUBMISSION REQUIREMENTS: Only ONE (1) single file (Word or PDF) must be submitted to Canvas before the deadline, which should include all of the followings: Cover page Table of Content All writing for part A All writing & tables required in part B All writing & calculations for part D All writing & calculation & Excel tables & Graphs for Part E All Reports generated from MYOB (Part C) ASSESSMENT CRITERIA Demonstration of a quality work submission Demonstration of the ability to: (10%) O Set up a partnership business in practice and understand how accounting principles are applied in business (20%) (20%) o Analyze the business performance for the period of operation Demonstration of the ability to use MYOB & accounting principles to record for business transactions (sales/purchases/ cash collections & payments/ general journals...) (30%) Demonstration of the technical skills of using Excel to construct Depreciation schedule for NCA and knowledge required to account for depreciation expense using different methods (20%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To meet the submission requirements for this assessment students should follow these guidelines 1 Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started