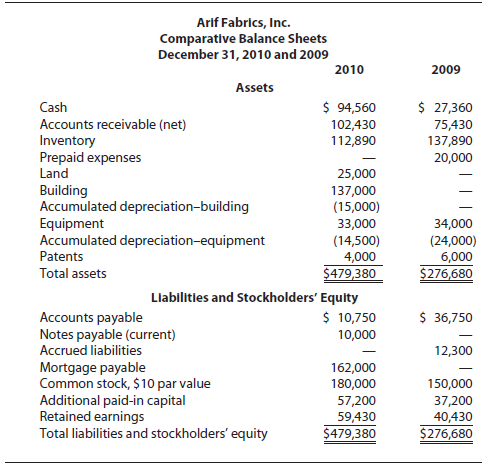

The comparative balance sheets for Arif Fabrics, Inc., for December 31, 2010 and 2009 appear below. Additional

Question:

The comparative balance sheets for Arif Fabrics, Inc., for December 31, 2010 and 2009 appear below.

Additional information about Arif Fabrics’s operations during 2010 is as follows: (a) net income, $28,000; (b) building and equipment depreciation expense amounts, $15,000 and $3,000, respectively; (c) equipment that cost $13,500 with accumulated depreciation of $12,500 sold at a gain of $5,300; (d) equipment purchases, $12,500; (e) patent amortization, $3,000; purchase of patent, $1,000; (f) funds borrowed by issuing notes payable, $25,000; notes payable repaid, $15,000; (g) land and building purchased for $162,000 by signing a mortgage for the total cost; (h) 1,500 shares of $20 par value common stock issued for a total of $50,000; and (i) paid cash dividend, $9,000.

Required

1. Using the indirect method, prepare a statement of cash flows for Arif Fabrics.

2. Why did Arif Fabrics have an increase in cash of $67,200 when it recorded net income of only $28,000? Discuss and interpret.

3. Compute and assess cash flow yield and free cash flow for 2010. What is your assessment of Arif’s cash-generating ability?

Free Cash FlowFree cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1439037805

9th edition

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson