3. Consider the two bonds described below: a. If both bonds had a required return of 8%,...

Question:

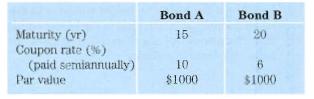

3. Consider the two bonds described below:

a. If both bonds had a required return of 8%, what would the bonds' prices be?

b. Describe what it means if a bond sells at a dis- count, a premium, and at its face amount (par value). Are these two bonds selling at a discount, premium, or par?

c. If the required return on the two bonds rose to 10%, what would the bonds' prices be?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets and Institutions

ISBN: 978-0321280299

5th edition

Authors: Frederic S. Mishkin, Stanley G. Eakins

Question Posted: