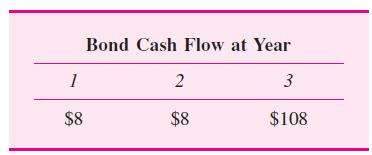

A 3-year coupon bond has payments as follows: This 8 percent coupon bond is currently trading at

Question:

A 3-year coupon bond has payments as follows:

This 8 percent coupon bond is currently trading at par ($100).

a. What is the annually compounded yield of the bond?

b. Compute the MacAuley duration and ordinary DV01 (calculated with respect to the annually compounded bond yield).

c. Using DV01, how much do you expect this bond’s price to rise if the yield on the bond declines by 10 basis points compounded annually?

Bond Cash Flow at Year 1 2 3 $8 $8 $108AppendixLO1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman

Question Posted: