A convertible bond can be converted into a specified number of shares of stock at the option

Question:

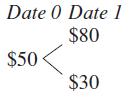

A convertible bond can be converted into a specified number of shares of stock at the option of the bondholder. Assume that a convertible bond can be converted to 1.5 shares of stock. A single share of this stock has a price that follows the binomial process

The stock does not pay a dividend between dates 0 and 1.

If the bondholder never converts the bond to stock, the bond has a date 1 payoff of $100 x, where x is the coupon of the bond. The conversion to stock may take place either at date 0 or date 1 (in the latter case, upon revelation of the date 1 stock price).

The convertible bond is issued at date 0 for $100. What should x, the equilibrium coupon of the convertible bond per $100 at face value, be if the risk-free return is 15 percent per period and there are no taxes, transaction costs, or arbitrage opportunities? Does the corporation save on interest payments if it issues a convertible bond in lieu of a straight bond? If so, why?AppendixLO1

Step by Step Answer:

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman