ABCOs head of risk management now warns of focusing on expected returns to the exclusion of risk

Question:

ABCO’s head of risk management now warns of focusing on expected returns to the exclusion of risk measures such as variance. ABCO decides to measure return variance.

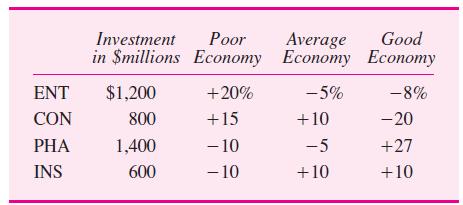

a. For each ABCO subsidiary, compute the return variance with the standard formula var ( ˜ r) E[( ˜ r r )2].

(i) The three economic scenarios are equally likely.

(ii) The good economic scenario is twice as likely as the other two.

b. Show that the alternative variance formula, from exercise 4.1, yields the same results.

ABCO is a conglomerate that has $4 billion in common stock. Its capital is invested in four subsidiaries:

entertainment (NET), consumer products (CON), pharmaceuticals (PHA), and insurance (INS). The four subsidiaries are expected to perform differently, depending on the economic environment.AppendixLO1

Step by Step Answer:

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman