Assume in exercise 4.9 that ABCO decides to borrow $8 billion at 5 percent interest to triple

Question:

Assume in exercise 4.9 that ABCO decides to borrow $8 billion at 5 percent interest to triple its current investment in each of its four lines of businesses. Assume this new investment has the same per dollar return outcomes as the old investment.

a. Answer parts a and b of exercise 4.9 given the new investment.

b. How does this result compare with the results from exercise 4.9? Why?

c. To whom does this return belong? Why?

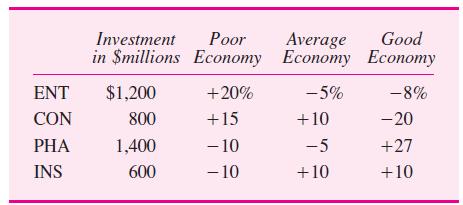

ABCO is a conglomerate that has $4 billion in common stock. Its capital is invested in four subsidiaries:

entertainment (NET), consumer products (CON), pharmaceuticals (PHA), and insurance (INS). The four subsidiaries are expected to perform differently, depending on the economic environment.AppendixLO1

Step by Step Answer:

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman