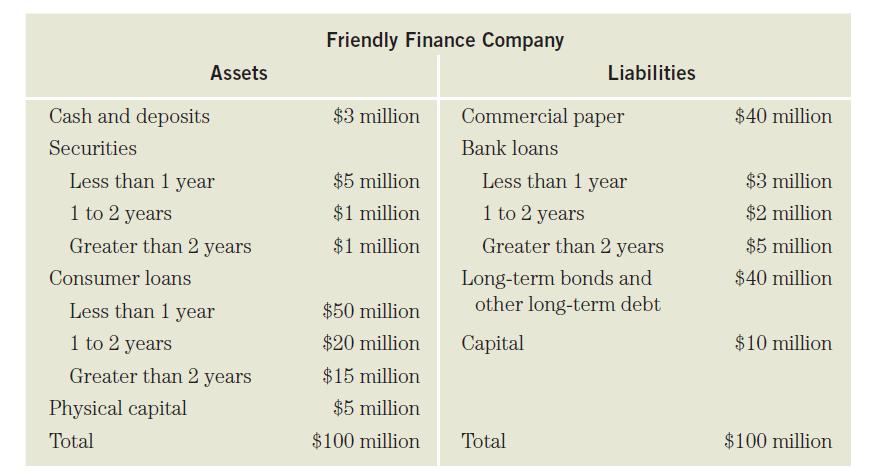

Assume that the Friendly Finance Company initially has the balance sheet shown on page 607 and that

Question:

Assume that the Friendly Finance Company initially has the balance sheet shown on page 607 and that interest rates are initially at 8%.

If the manager of the Friendly Finance Company decides to sell off $10 million of the company's consumer loans, half maturing within one year and half maturing in greater than two years, and uses the resulting funds to buy $10 million of Treasury bills, what is the income gap for the company? What will happen to profits next year if interest rates fall by 5 percentage points? How could the Friendly Finance Company alter its balance sheet to immunize its income from this change in interest rates?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Institutions

ISBN: 9781292215006

9th Global Edition

Authors: Stanley Eakins Frederic Mishkin

Question Posted: