Compute the value of Hughes if GMs cost of capital is used as a discount rate instead

Question:

Compute the value of Hughes if GM’s cost of capital is used as a discount rate instead of the cost of capital computed from the comparison firms.

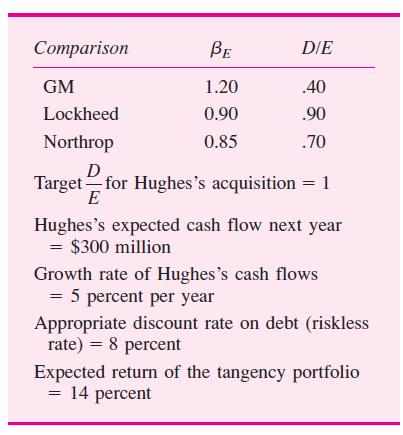

In 1989, General Motors (GM) was evaluating the acquisition of Hughes Aircraft Corporation.

Recognizing that the appropriate discount rate for the projected cash flows of Hughes was different than its own cost of capital, GM assumed that Hughes had approximately the same risk as Lockheed or Northrop, which had low-risk defense contracts and products that were similar to Hughes. Specifically, assume the following inputs:AppendixLO1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman

Question Posted: