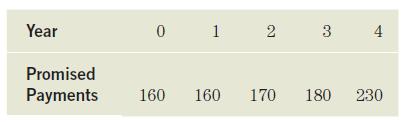

Consider a bond that promises the following cash flows. The yield to maturity is 12%. You plan

Question:

Consider a bond that promises the following cash flows. The yield to maturity is 12%.

You plan to buy this bond, hold it for 2.5 years, and then sell the bond.

a. What total cash will you receive from the bond after the 2.5 years? Assume that periodic cash flows are reinvested at 12%.

b. If immediately after you buy this bond all market interest rates drop to 11% (including your reinvestment rate), what will be the impact on your total cash flow after 2.5 years? How does this compare to part (a)?

c. Assuming all market interest rates are 12%, what is the duration of this bond?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Institutions

ISBN: 9781292215006

9th Global Edition

Authors: Stanley Eakins Frederic Mishkin

Question Posted: