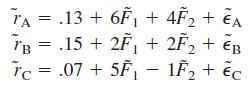

Consider the following two-factor model for the returns of three stocks. Assume that the factors and epsilons

Question:

Consider the following two-factor model for the returns of three stocks. Assume that the factors and epsilons have means of zero. Also, assume the factors have variances of .01 and are uncorrelated with each other.

If what are the variances of the returns of the three stocks, as well as the covariances and correlations between them?AppendixLO1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman

Question Posted: