For each of the six cases in exercise 4.14, ABCO wants to consider what would happen to

Question:

For each of the six cases in exercise 4.14, ABCO wants to consider what would happen to the return variance of ABCO’s $4 billion in stock if it revised the relative investment proportions in the two remaining subsidiaries. In particular, for each of the six possible sell-off scenarios, what proportion of the $4 billion should be invested in the two remaining subsidiaries if ABCO were to minimize its variance? Assume that short sales are not permitted.

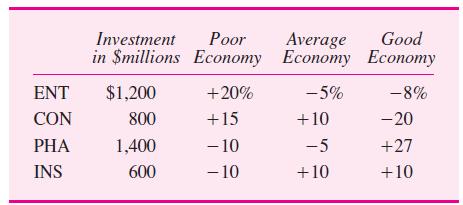

ABCO is a conglomerate that has $4 billion in common stock. Its capital is invested in four subsidiaries:

entertainment (NET), consumer products (CON), pharmaceuticals (PHA), and insurance (INS). The four subsidiaries are expected to perform differently, depending on the economic environment.AppendixLO1

Step by Step Answer:

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman