ABCO is considering selling off two of its four subsidiaries and reinvesting the proceeds in the remaining

Question:

ABCO is considering selling off two of its four subsidiaries and reinvesting the proceeds in the remaining two subsidiaries, keeping the same relative investment proportions in the surviving two. Assuming that the three economic scenarios are equally likely, compute the return variance of the $4 billion in ABCO stock for each of the six possible pairs of subsidiaries remaining.

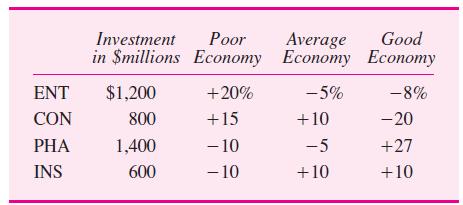

ABCO is a conglomerate that has $4 billion in common stock. Its capital is invested in four subsidiaries:

entertainment (NET), consumer products (CON), pharmaceuticals (PHA), and insurance (INS). The four subsidiaries are expected to perform differently, depending on the economic environment.AppendixLO1

Step by Step Answer:

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman