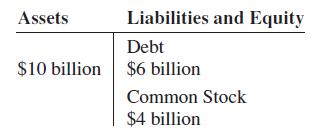

The Alumina Corporation has the following simplified balance sheet (based on market values) a. The debt of

Question:

The Alumina Corporation has the following simplified balance sheet (based on market values)

a. The debt of Alumina, being risk-free, earns the risk-free return of 6 percent per year. The equity of Alumina has a mean return of 12 percent per year, a standard deviation of 30 percent per year, and a beta of .9. Compute the mean return, beta, and standard deviation of the assets of Alumina.

Hint: View the assets as a portfolio of the debt and equity.

b. If the CAPM holds, what is the mean return of the market portfolio?

c. How does your answer to part a change if the debt is risky, has returns with a mean of 7 percent, has a standard deviation of 10 percent, a beta of .2, and has a correlation of .3 with the return of the common stock of Alumina?AppendixLO1

Step by Step Answer:

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman