This case is intended to illustrate how forecasting exchange rates and hedging decisions are related. Blackhawk Company

Question:

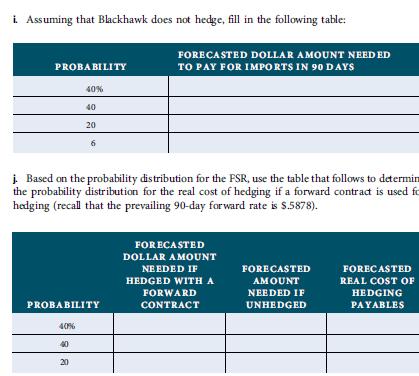

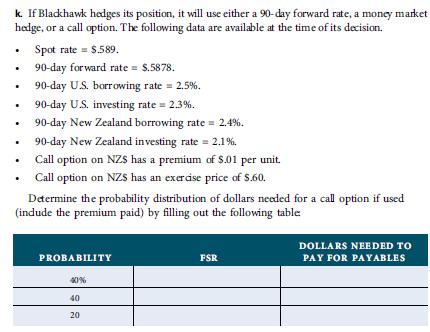

This case is intended to illustrate how forecasting exchange rates and hedging decisions are related. Blackhawk Company imports goods from New Zealand and plans to purchase NZ$800,000 1 quarter from now to pay for imports. As the treasurer of Blackhawk, you are responsible for determining whether and how to hedge this payables position. Several tasks will need to be completed before you can make these decisions.

The entire analysis can be performed using LOTUS or Excel spreadsheets. Your first goal is to assess three different models for forecasting the value of NZ$ at the end of the quarter (also called the future spot rate, or FSR).

• Using the forward rate (FR) at the beginning of the quarter.

• Using the spot rate (SR) at the beginning of the quarter.

• Estimating the historical influence of the inflation differential during each quarter on the percentage change in the NZ$ (which leads to a forecast of the FSR of the NZ$).

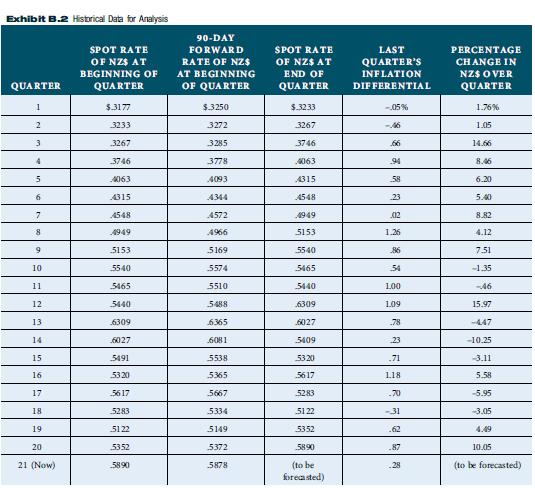

The historical data to be used for this analysis are provided in Exhibit B.2.

a. Use regression analysis to determine whether the forward rate is an unbiased estimator of the spot rate at the end of the quarter.

b. Use the simplified approach of assessing the signs of forecast errors over time. Do you detect any bias when using the FR to forecast? Explain.

c. Determine the average absolute forecast error when using the forward rate to forecast.

d. Determine whether the spot rate of the NZ$ at the beginning of the quarter is an unbiased estimator of the spot rate at the end of the quarter using regression analysis.

e. Use the simplified approach of assessing the signs of forecast errors over time. Do you detect any bias when using the SR to forecast? Explain.

f. Determine the average absolute forecast error when using the spot rate to forecast. Is the spot rate or the forward rate a more accurate forecast of the future spot rate (FSR)?

Explain.

g. Use the following regression model to determine the relationship between the inflation differential (called DIFF and defined as the U.S. inflation minus New Zealand inflation)

and the percentage change in the NZ$ (called PNZ$):

PNZ$ ¼ b0 þ b1DIFF Once you have determined the coefficients b0 and b1, use them to forecast PNZ$ based on a forecast of 2 percent for DIFF in the upcoming quarter. Then, apply your forecast for PNZ$ to the prevailing spot rate (which is $.589) to derive the expected FSR of the NZ$.

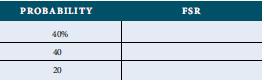

h. Blackhawk plans to develop a probability distribution for the FSR. First, it will assign a 40 percent probability to the forecast of FSR derived from the regression analysis in the previous question. Second, it will assign a 40 percent probability to the forecast of FSR based on either the forward rate or the spot rate (whichever was more accurate according to your earlier analysis). Third, it will assign a 20 percent probability to the forecast of FSR based on either the forward rate or the spot rate (whichever was less accurate according to your earlier analysis).

Fill in the table that follows:

l. Compare the forward hedge to the money market hedge. Which is superior? Why?

m. Compare either the forward hedge or the money market hedge (whichever is better)

to the call option hedge. If you hedge, which technique should you use? Why?

n. Compare the hedge you believe is the best to an unhedged strategy. Should you hedge or remain unhedged? Explain.

Step by Step Answer: