4. Suppose that the spot exchange rate today between the U.S. dollar and the currency of country...

Question:

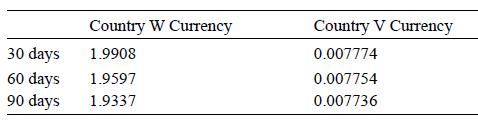

4. Suppose that the spot exchange rate today between the U.S. dollar and the currency of country W is U.S. $1.9905 per unit of currency of country W, and that for the U.S. dollar and the currency of country V is U.S. $0.00779 per unit of country V. The following forward rates are also quoted today:

a. Explain what someone who enters into a 30-day forward contract to deliver the currency of country W is agreeing to do.

b. Explain what someone who enters into a 90-day forward contract to buy the currency of country V is agreeing to do.

c. What can you infer about the relationship between U.S. and country W’s short-term interest rates and U.S. and country V’s short-term interest rates?

Step by Step Answer:

Foundations Of Global Financial Markets And Institutions

ISBN: 9780262039543

5th Edition

Authors: Frank J. Fabozzi, Frank J. Jones, Francesco A. Fabozzi, Steven V. Mann