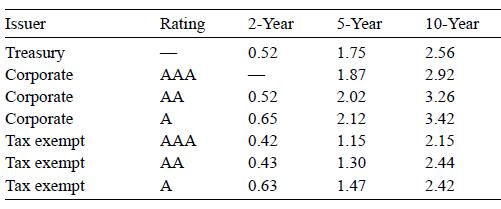

4. The following yields were reported on August 4, 2014, for U.S. Treasury securities, corporate bonds, and

Question:

4. The following yields were reported on August 4, 2014, for U.S.

Treasury securities, corporate bonds, and tax-exempt bonds (i.e., municipal bonds):

a. Why is the yield on a tax-exempt security less than the yield on a Treasury security of the same maturity and credit rating?

b. Why is the yield on a tax-exempt security less than the yield on a corporate security of the same maturity and credit rating?

c. What appears to be the relationship between yield and maturity for corporate bonds?

d. For an investor in the 40% marginal tax bracket, compare the yield on the two-year AA-rated corporate bond and the tax-exempt bond on an equivalent-taxable yield basis.

Step by Step Answer:

Foundations Of Global Financial Markets And Institutions

ISBN: 9780262039543

5th Edition

Authors: Frank J. Fabozzi, Frank J. Jones, Francesco A. Fabozzi, Steven V. Mann