8. You obtain the following price quotes for call options on Asset ABC. It is now December,...

Question:

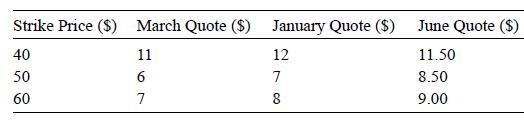

8. You obtain the following price quotes for call options on Asset ABC.

It is now December, with the near contract maturing in one month’s time. Asset ABC’s price is currently trading at $50.

Glancing at the figures, you note that two of these quotes seem to violate some of the rules you learned regarding options pricing.

a. What are these discrepancies?

b. How could you take advantage of the discrepancies? What is the minimum profit you would realize by arbitraging based on these discrepancies?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations Of Global Financial Markets And Institutions

ISBN: 9780262039543

5th Edition

Authors: Frank J. Fabozzi, Frank J. Jones, Francesco A. Fabozzi, Steven V. Mann

Question Posted: