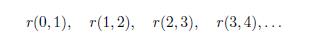

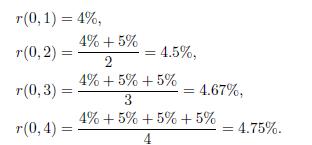

Let us consider an array of continuously compounded spot interest rates for time periods of one year:

Question:

Let us consider an array of continuously compounded spot interest rates for time periods of one year:

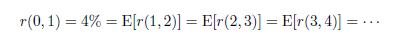

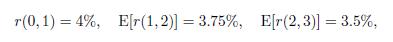

Say that no increase is expected and

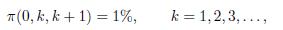

If the risk premium is

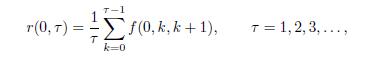

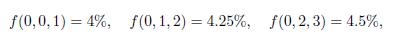

Then, the term structure is an average of forward rates,

which in this specific case yields

Thus, we observe an increasing term structure, even though there is no expected increase in the spot rates.

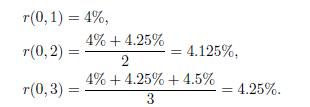

It may even happen that an increasing term structure results from decreasing expected spot rates, if the liquidity premium is increasing. For instance, let us consider

and

Then, in this case, we find

and

The resulting term structure is increasing, even though rates are expected to drop.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: